Time-2-rent

Case Statement :

Your client is a vacation rental company focused on short-term homestays and experiences. They have been growing in India but are looking to localize their company in the Indian markets. The management is looking at potential M&A activities for the same.

Interview Transcript

Your client is a vacation rental company focused on short-term homestays and experiences. They have been growing in India but are looking to localize their company in the Indian markets. The management is looking at potential merger & acquisition activities for the same. You’ve been on- boarded as a consultant, and the client wants you to advise them on their M&A plans.

Alright, I would like to understand the client and the problem statement a little better.

Do they have any specific targets in terms of revenue growth or is it for a strategic motive

What do you mean by localizing the company?

Do they own these places or just act as aggregator?

They do not have any specific target in mind. They are just looking to expand their business in India localizing here means improving our foothold in semi urban areas ie., increasing reach and accessibility to the customers. The client owns a chain of 50 vacation spaces around India that offers short stay.

What is the location of these vacation spaces and what are the most prominent customers of our client?

Out of the above 50 spaces, 45 of them lie in Tier 1 cities and the rest are spread across Tier 2 and Tier 3 cities. 65% of our customers are people who prefer to stay in low-cost accommodations.

Also do we have any particular companies in mind that we can acquire?

Yes we have a prospective company in mind for acquisition, Zosle.

Okay, can you give me the details about Zosle and how are we going to finance the deal?

Zosle leases rooms and sell them under its brand name. They renovate the places according to its checklist of standard services and make the property a part of its “standardized budget staycation chain”. The main target customers for them will be the tourists that are looking for budget-friendly stays. They are looking to be acquired for Rs. 120 Cr. This will be an all-cash deal. These are all the details. Now you can start with your structure:-

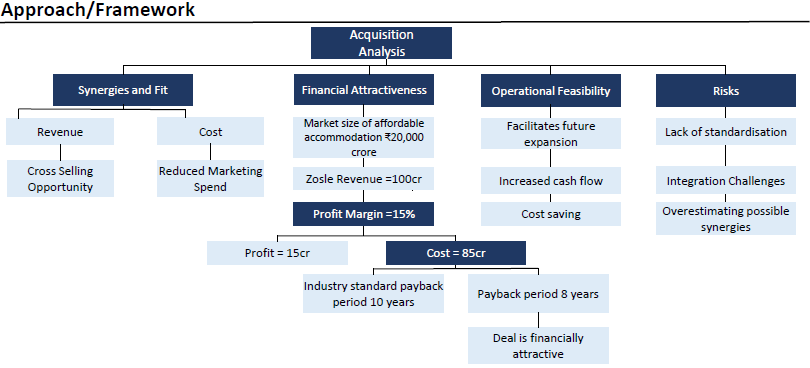

So, in order to evaluate an acquisition, I would follow this 4-legged approach. Financial feasibility Here I would calculate the profitability value of the project using the NPV method or whether the acquisition results in accretion of EPS. Operational feasibility – Challenges and problems that need to be tackled to undertake the entire process.

Synergies and fit – Advantages or opportunities that the company will have after this acquisition. Risks – Any potential risks that need to be taken into consideration before going with the acquisition. Okay, fair enough, you can start with the financial analysis.

Okay, so to calculate the financial attractiveness, I’ll start with the estimation of market size of the accommodation industry in tourist spaces. If the addressable market is in line with our clients’ line, then I can do payback period analysis for the acquisition and can compare it with the industry

standards.

Fine go ahead with your approach for estimation of the market.

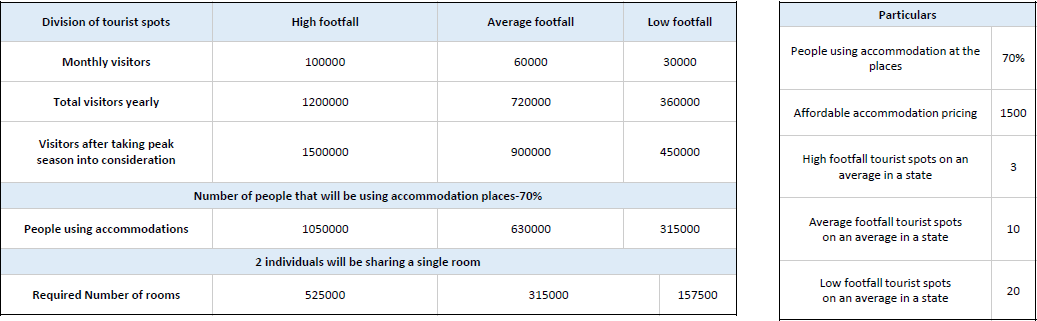

So to initiate my calculation, I’ll start with places and then I’ll multiply it with such tourism spots across India. I’ll bifurcate these spots into three types. Spots with high, average and low footfall. These spots will be mainly focused upon eco, adventure, cultural and wildlife tourism. Then, after taking peak season into consideration, I’ll calculate the yearly footfall at these places. Post that I’ll

add a filter of the percentage of people that will be using the rooms and the number of rooms that will be required by 2 individuals.

Okay, why have you taken rooms requirement according to 2 individuals. Nowadays there are a lot of people who travel solo and don’t share room with anyone.

According to my assumption, the chunk of people travelling alone or solo is less, only 4-5% maybe and people prefer to travel along with friends and family, so in order to average it. I have taken it to

be 2.

Okay fair enough continue with your approach.

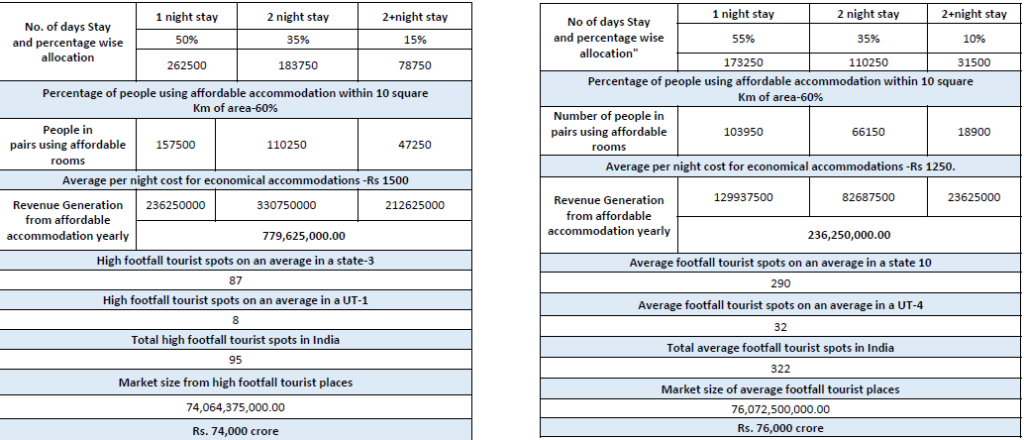

Now I’ll take into account the duration of the stay of these travelers, because people try to travel to these places over the weekends or on some long holidays. I have divided their stay duration into 1, 2 and more than 2 days of stay. Given the spending nature of Indians, as they will be the major constituents that will be coming to these places, they will try to make their accommodations economical. So I have assumed around 60% of these will be using budget friendly accommodations within 10 sq. km of area. Post this I’ll assume an average price of Rs. 1500, Rs. 1250 and Rs. 1000 for one night stay.

amount of market size too.

So how would you estimate the number of such spots across India? Also, it provides me with the final

Since the total area of India is around 3200 sq km with 29 states and 8 Union territories in India, I’ll assume the average size to be 100 sq km., (Approximately-3000 sq km/assumption of 29 states). That is almost equivalent to the area of Telangana, taking it as a reference for the number of tourist spots. Similarly I’ll assume the average size of UT’s to be 40% of state. After plugging the numbers into the above filters the market size comes out to be around Rs. 20000 crores for affordable accommodations.

Okay the market size number looks fine. Let’s say that Zosle will have a market share of 0.5% as it will face high competition from organized and unorganized segment going forward. Do payback period analysis from this information. Given that industries standard payback period is 10 yrs.

So, with 0.5% of the market share, our revenue would come out to be around the 100 Cr and since peers such as the poyo have a profit margin of 15%, we can assume the same for Zosle too. Therefore, the profit comes out to be 15 Cr and the cost comes to be 85 Cr. Assuming that the cost and revenue structure will be same for the next 10 years. The payback period would be 8 yrs. So this makes our deal financially attractive.

While going forward, what do you think could be the potential synergies of this acquisition?

Along with having access to new customers, this acquisition would provide us with a cross-selling opportunity in terms of pushing our staycation packages of far-located spaces to the customers. While going forward, we can also advertise and brand Zosle under our brand. This would reduce the marketing spends of the acquiree company.

Can you list some other benefits that the company can get out of this acquisition?

Since Zosle follows an asset light business model, a franchise-based business will help in avoiding a lot of major costs i.e., maintenance cost, licensing cost, etc.

In future, the expansion plans will become much easier for clients. It will also provide you with an upfront cash payment while signing new businesses (staycation places) that will improve the cash position of the company. It will also help in avoiding unnecessary legal compliance and red tapism that is involved during the acquisition of land.

What do you think would be the risks associated with this acquisition?

The first risk that is associated with this deal is lack of standardization in due time of the properties

that would come with this acquisition. The user experience might get affected if due attention is not

given to the process. Another issue that might arise is the integration challenge as a post merger

integration is essential to synergize the work of both companies.

Okay, you can close the case now.

Case Facts

- Overview-Client is a vacation rental company in India who is looking to localize the company in India.

- CurrentScenario–They own 50 vacation spaces in India.

- Way ahead–Looking to expand through a potential M&A activity.

Case Recommendation

- The Client is advised to go forward with ZOSLE as the potential synergies that come with the acquisition are in line with the client’s interest. As, the deal is financially attractive too.

Brownie Points

- Assessment of financial attractiveness through buy back period analysis.

- Taking different prices into consideration for economical accommodations across India.

Guesstimates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.