HARVESTING CAPITAL

Case Statement :

Your client is a private equity firm looking to invest in an Agri-Tech company. The company; AgriResis seeking funds for their business which involves conversion of crop residue into repurposed materials through an eco-friendly & cost effective process. Advise the client on this investment

Interview Transcript

You are working as an external consultant for a private equity firm that is interested in investing in an Agri-Tech company. The company is raising funds for their business, which involves converting crop residue into repurposed materials. The company claims that their process is environmentally friendly, cost-effective, and has a high demand in the market. The company is seeking a private equity investment from your firm, and you have been hired to analyze the effectiveness of such an investment.

Okay, I have a few questions. First, what is the name of the company and where is it based? Second, what are the repurposed materials that the company produces and who are their customers? Third, how much funding is the company looking for and what is the expected return on investment?

The name of the company is AgriRes, and it is based in India. The repurposed materials that the company produces are mainly biochar and biogas, which are used as soil enhancers and renewable energy sources respectively. The company’s customers are mainly farmers, who use biochar to improve their crop yield and soil quality, and manufacturers, who use biogas to power their factories and reduce their carbon footprint. The company is looking for $50 million in funding and expects a 25% internal rate of return (IRR) on the investment.

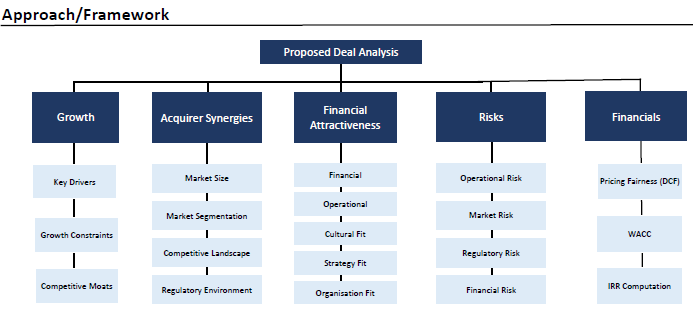

Thank you. In order to provide a recommendation on whether to invest or not. I would like to analyze four main aspects of the case: first, the industry and market dynamics of the agritech sector, and the potential growth and profitability of the repurposed materials market. Second, the company and its business model, and how it differentiates itself from its competitors and creates value for its customers and stakeholders. Third, a financial and valuation analysis of the company, and estimate its current and future cash flows, profitability, and valuation. Fourth, a recommendation on whether to invest or not, and identify the main risks and uncertainties associated with the investment.

Does that sound like a reasonable approach?

Yes, that sounds like a good structure. Let’s start with the first part, the industry and market analysis. What are some of the factors that you would consider to analyse the industry and market dynamics of the agritech sector and the repurposed materials market?

Some of the considerations includes the size & growth of the agritech sector & the repurposed materials market, both globally & in India. Additionally, the demand and supply drivers and

trends of the repurposed materials market, and the customer segments and needs. Also, the

competitive landscape and the key players and their market shares, strengths, and weaknesses followed by the regulatory and environmental factors and the potential opportunities and threats

for the agritech sector and the repurposed materials market.

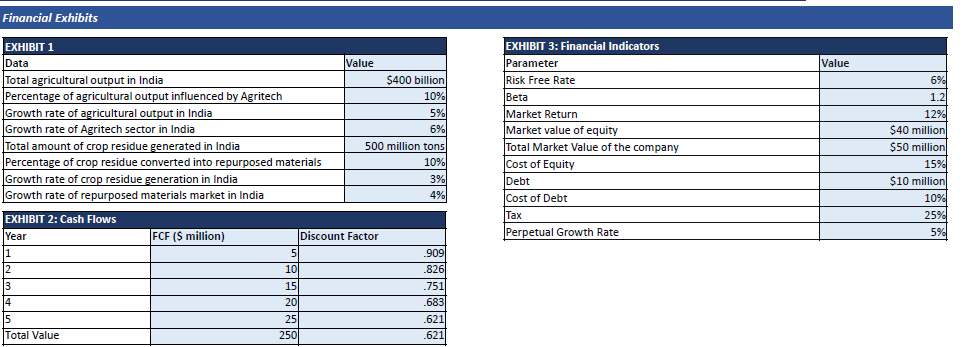

Okay. Estimate the size and growth of the agritech sector and the repurposed materials market? Please refer to Exhibit 1.

The estimated size of the agritech sector is $400 billion, and 10% of it is influenced by agritech, then the size of the agritech sector in India would be $40 billion.

- The agricultural output in India grows at 5% per year, then the agritech sector could grow at 5% or higher, depending on the adoption and innovation of agritech solutions. • The total amount of crop residue generated in India is 500 million tons per year, and 10% of it is

converted into repurposed materials, then the size of the repurposed materials market in India would be 50 million tons per year.

- The crop residue generation in India grows at 3% per year, then the repurposed materials market could grow at 3% or higher, depending on the demand & supply of repurposed materials.

Let’s move on to the second part, analyzing the company and its business model. How would you go about assessing AgriRes and its business model in the agritech landscape?

Firstly, investigating the satisfaction level of farmers and manufacturers who are utilizing AgriRes’

products. Moreover, I’d explore the company’s marketing strategies, distribution channels, and the sustainability of their relationships with customers. Secondly, I’d examine their growth plans, operational scalability, potential expansion into new

markets, & the adaptability of its business model to changing dynamics & regulations. Thirdly, market positioning, competitors, their strengths, weaknesses, market shares, & any

innovations they might have. This would help highlight AgriRes’ distinct advantages & potential risks.

Lastly, I’d examine AgriRes’ methods to convert crop residue into biochar & biogas, emphasizing uniqueness, efficiency, scalability, & technological advantages or intellectual property rights compared to competitors.

That’s a comprehensive approach. Moving forward, could you discuss how relationship of AgriRes with customers impact its business model & growth potential

Case Facts

- The client is a private equity firm interested in investing in an AgriTechcompany.

- AgriResis an India based AgriTechcompany looking to raise $50 million in funding with an expected IRR of 25% .

- AgriRes’ customers are farmers & manufacturers who use biochar& biogas respectively.

- The company claims that their process is environmentally friendly, cost-effective, and has a high demand in the market.

Case Recommendation

- The investment is acceptable & profitable.

- The IRR is higher than the expected rate of return.

- The investment is undervalued & has a NPV of more than 150 million according to DCF valuation

Brownie Points

- A comprehensive & structured approach which includes both quantitative & qualitative factors.

- A detailed explanation about the business model of the company & the risks associated with it.

Exhibits

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.