CAREFUL!

Case Statement :

The client has identified a particular arm of the business in a specific geographical location which they want to sell. They want us to conduct a due diligence study. Devise an approach for this and highlight considerations for this?

Interview Transcript

Your client is a RootNet, is the largest telecom player in the world. The client has identified a particular arm of the business in a specific geographical location which they want to sell. They want us to conduct a due diligence study. How would you approach this and what would your considerations be?

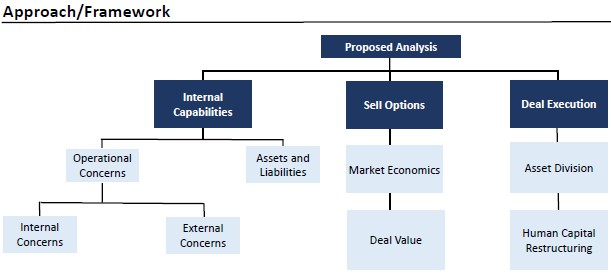

Sure, I would like to begin with breaking down the analysis into 3 sections-Internal Analysis, Sell Options, Deal Execution and Implementation. I would like to know more about the client.

Ok sure, please go ahead

Yeah, so I’d like to start with internal analysis. I would like to understand what is the issue that is causing the client to sell of a business unit- is it based on external or internal factors?

So, the client is looking to sell off their Indian business unit. While the unit has been extremely profitable, recent government regulations are favoring its Indian Competitors, who are able to offer services at comparatively lower prices. Company does not expect the policy to change anytime soon and sees stagnant growth going forward.

So, I understand this decision of theirs is supported by external factors such as government policies and competition’s pricing, leading to lower growth. Can I understand the client’s capabilities in this region?

The client owns multiple offices across the country, in Pune, Gurgaon & Bangalore. They have all

necessary compliances and contracts to run business for the next 3 years, with all standard equipment required in this business.

Now that I have a clear idea of the client’s reasoning behind selling and its capabilities, I would like to understand the sell options the client has.

The client has multiple competitors & new entrants bidding on various percentages of majority stake ownership and the client needs to decide the best of options to sell.

Considering that the unit has been profitable before the new regulations, the client should look at the market economics and growth potential to understand what percentage of minority ownership would they like to retain.

Apart from ownership stake, the client needs to consider the capabilities and assets it owns and what would provide the best deal value.

We should further judge the competency and capabilities of our bidders to understand where could we have a synergistic handover with reduced transfer costs..

After deciding on selling a majority stake while still holding 49% of the unit what would be the next step towards completing the sell off?

We would next consider our deal execution and implementation considerations. We need to categorize components of our business into critical and noncritical, setting aside the critical part which cannot be transferred to the buyer.

We the need to consider the needs of the acquirer and what they require in maximizing their business benefit. Finally, the staffing and organization restructuring needs to be implemented. Emphasis needs

to be on ensuring transparency for all stakeholders.

Thank you for your approach, I think we can end the discussion here.

Case Facts

- Client is the largest telecom player in the world.

- Recent changes in government policies have strengthened the position of the competitors.

- Multiple bids were offered for buying the unit/ stake in the unit, however the company chooses to retain the minority stake of 49%

Case Recommendation

- Ensuring capability, competency and synergy in business with the new acquirer.

- Ensuring complete transparencywith stakeholders during the process

Brownie Points

- Knowing the sell side due diligence framework

- Suggesting acquisition by an experienced player, to back company’s growth

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.