The Booming FMCG Sector in India

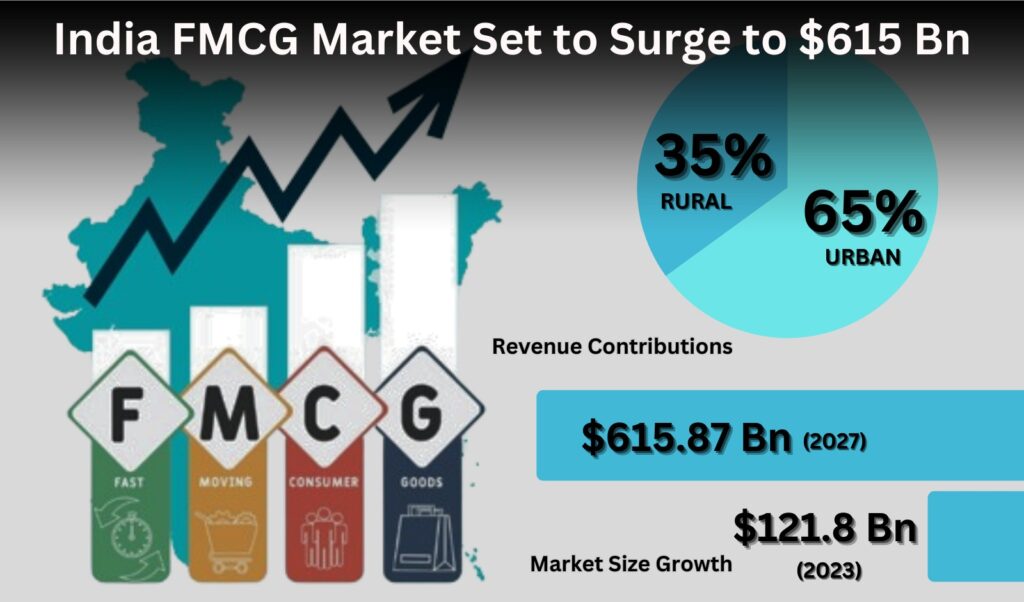

As we know that India is the fifth biggest economy in the world. All the major economies have

high consumption of Fast-Moving Consumer Goods (FMCG). The same case is with India as

well. According to many reports, The FMCG industry of India is the fourth largest sector in the

Indian economy. This industry is expected to reach a market size of around $220 billion by

2025. In 2024, FMCG Market is valued around $192 Billion. Urbanization, a fast growing

middle class, and increased disposable incomes of individuals are the key main drivers of the

FMCG sector’s 9-12% annual growth and the Compounded Annual Growth Rate (CAGR) is

27.9% from 2021 to 2027. Nearly 36% of FMCG sales come from rural consumers, highlighting

the sector’s contribution to India’s economic development. This sector also provides major

employment to over 3 million people directly and many more indirectly.

Shark Tank India and the Rise of Innovation

The Indian Consumer started giving more attention to Startups when The Shark Tank was launched in India on 20 December, 2021, which also includes the FMCG Industry. The Shark Tank mainly focused on providing investment to startups in which they see potential and the sharks invest their own money which they think is needed for the startup to grow. Including all the 3 seasons till now, the show has funded around ₹20 crore investment to FMCG sector only, which is 15-20% of total investments done in Shark Tank. These businesses focus on niche consumer needs such as sustainable packaging to health-focused snacks and many more needs. The show has turned the spotlight on emerging startups and brands, which help them to get funding, mentorship, and visibility in a highly competitive market. Also, the Shark brings their experience to the business, which is the most crucial element of success for any startup.

Investment: Challenges and Rewards

While the FMCG sector offers immense potential, attracting investments always comes with

challenges. This market has over 15,000 brands which are competing for consumer attention,

making differentiation and brand loyalty crucial. As any other industry, distribution remains a

hurdle in this as well, around 63% of retail outlets are still operating in unorganized formats.

Strong brands in this sector often enjoy the EBITDA margins of around 25-30%. India’s FMCG

market is going to double within five years and shows like Shark Tank India are helping in

fostering innovation and providing crucial insights to Founders as well as viewers

Market Dynamics of the Indian FMCG Sector

The Indian FMCG sector is a powerhouse of the national economy, currently valued at $110

billion as of 2023, and is poised to grow to $220 billion by 2025, registering a robust CAGR of

14.9%.

- Food & Beverages contributes 50% share. It includes packaged foods, healthy snacks, and ready-to-eat meals driving growth.

- Personal Care Products contributes 22% share. It includes grooming essentials: skincare, hair care, and wellness products.

- Household Care contributes around 10% share, such as high demand for detergents, disinfectants, and air fresheners.

The rural FMCG market, a significant driver of growth, is projected to expand from $23 billion in

2020 to $100 billion by 2030, reflecting a strong shift in rural consumer behavior toward

branded and premium products.

What Sharks Look before investing in FMCG Startups?

Sharks on platforms like Shark Tank India evaluate FMCG startups through a lens of strategic

growth, innovation, product market fit and market size. Here’s what most matter to them:

Product Innovation: Products that solve real-world problems, align with new trends, target

untapped markets, or are completely unique in their field.

In Shark Tank India season 1, Ashneer Grover and Namita Thappar funded Tagz Foods

startup, which offers pop chips as snacks to health-conscious consumers.

Financial Metrics is one of the most important key factors that investors look at in a business. The key metrics include Gross Margins, which should be between 40-60% to ensure profitability even with high marketing and distribution costs. Startups with better margins can spend more on branding and customer acquisition. Another important indicator is the CAC-to-CLV ratio, that is, the cost for acquiring one customer and how much money a customer has brought to the business over time. Ideally, if the ratio reaches 1:3 and above, it means they have retained their customers properly and have long-term profitability. Consistent revenue and growth rates with the sales going up by 10-20% on a monthly basis are necessary indicators of scalability.

Other important aspects include the Break-even Point, the point at which sales equal all

costs. Another two important metrics are the Burn Rate (monthly costs of running the

business) and Runway (months a company can run without needing additional cash to pay for expenses). Those with a low burn rate and a longer runway make more attractive investment opportunities. Last but not least, Sales Conversion Rates, expressed as the percentage of leads that become paying customers, illustrate customer interest and thus great product-market fit.

Sharks also focus on scalability of the startup. The sharks see whether production, supply chain, and distribution can be scaled up for rising demand. Startups with a rich supply chain network and penetration of both organized and unorganized markets like India’s 15 million retail outlets are highly scalable. Further growth can be achieved by tying up with local kirana stores, thereby enabling startups to scale up sales by 3x in rural areas.

Sharks evaluate factors like the Net Promoter Score (NPS), with scores above 70 reflecting

excellent customer loyalty, and positive reviews and testimonials that assure product quality.

Strong branding efforts, such as celebrity endorsements, can significantly enhance a startup’s

appeal to investors, as seen in a beverage startup that secured ₹2 crore in funding with an NPS

of 75.

Key Performance Indicators (KPIs)

FMCG startups must demonstrate healthy metrics that reveal their growth and operational efficiency:

KPIs for FMCG startups include metrics showing growth and operational efficiencies. Revenue Growth Rate would probably be one of the most relevant measures to indicate market demand as well as the capability in execution. As long as revenue stays at 30-50 percent YoY, very strong momentum remains in the business. Great examples of such growth stories can be found in D2C where revenue scaled up from ₹50 lakh to ₹1 crore within a year. Burn Rate—or the monthly operating costs—has to be low. The acceptable burn rate for seed-stage companies is generally less than ₹10 lakh per month.

Another key number is the Run Rate, which annualizes the latest performance on revenue. More than ₹1 crore a year is very good as this reflects scalability and an attractive prospect. Customer retention of more than 60% indicates high customer satisfaction and loyalty. For instance, a skincare company with a retention rate of 65% gains capital from steady users. Lastly, Gross Margins of 40-60% ensure profitability, allowing startups to reinvest in marketing and R&D for continuous growth and competitiveness.

Collectively, these KPIs make the startup healthy, scalable, and sustainable, thereby making it an attractive investment.

Role of the Founder

The founding qualities are a prerequisite to fundraising. Sharks like founders who have passion and vision. This gives them confidence in succeeding in the long term. Flexibility is key, along with a deep understanding of the FMCG market and consumer behavior. A founder who opens himself up for feedback is growing. Example: The founder of a healthy snack company raised ₹1 crore investment on Shark Tank India after showcasing a profound understanding of the product and a sound vision for scaling the business.

Trends That Captivate Sharks

Some attractive trends for sharks include the rise of plant-based foods, which are growing at a CAGR of 30% and are expected to reach ₹4,000 crores by 2025. Products developed with eco-friendly, biodegradable, or zero-waste packaging are particularly appealing since 60% of consumers prefer such options. The health-based FMCG sector is also growing at a CAGR of 15%, driven by increased awareness of nutritional requirements. Additionally, e-commerce and digital marketing are reshaping growth strategies. D2C FMCG sales are projected to hit ₹1 lakh crore by 2025. This digital transformation impressed the sharks, as a beverage brand’s Instagram campaigns reported 50% YoY growth with a digital-first approach.

Case Studies and Examples

- TagZ Foods: This premium snacks brand, founded by Anish Basu Roy, secured ₹70 lakh on Shark Tank India by highlighting its innovation—low-fat chips made using vacuum cooking—and consistent revenue growth of ₹1 crore/year. The investment was made by Ashneer Grover for an exchange of 2.75% equity. The rationale behind his investment was the brand’s focus on health-conscious snacking appealing to the GenZ audience and its innovative cooking technology.

- Beyond Water: A startup offering liquid water enhancers, founded by Chahat Anand, raised ₹75 lakh from sharks Aman Gupta and Namita Thapar for an exchange of 15% equity. The main rationale behind their investment was that the product is unique in nature and has a projected growth rate of 3x annually in the hydration market.

- Skippi Ice Pops: The first ice pop brand, founded by Ravi Kabra, raised ₹1 crore for an exchange of 15% equity. Its eco-friendly and nostalgic product, coupled with other reasons such as a strong e-commerce presence contributing 60% of sales, attracted the Sharks. The investment was made by all five Sharks: Aman Gupta, Ashneer Grover, Peyush Bansal, Namita Thapar, and Anupam Mittal. Their rationale behind the investment was the brand’s novelty, unique market position, and scalability of the product.

Challenges, Pitfalls, and Founder Shortcomings

Startups, particularly in the FMCG sector, often face several common pitfalls that can hinder

their chances of securing investment:

- The biggest challenge for FMCG startups is overestimating the market size. Saying there is a ₹1,000-crore market without any data or validation weakens the credibility. Investors want evidence of consumer demand backed by rigorous market research.

- The next is overvaluation. A ₹50-crore valuation with nil sales or no revenue sounds financially unsustainable. Valuations need to resonate with the actual financial performance and achievable growth projections. Gross margins below 40% and high burn rates are enough reasons for a red flag, so investors find it less attractive.

Conclusion: Aligning with Shark Expectations

Securing investment in FMCG requires a balance of innovation, scalability, strong financials, and entrepreneurial drive. Sharks seek entrepreneurs who can execute a vision, adapt to market changes, and tackle challenges. For Indian FMCG startups, aligning with Shark priorities—such as revenue growth, margins, and brand equity—increases the chance of turning ideas into sustainable businesses.