swap right

Case Statement :

Your client is WholesaleCo (a big box retail chain) and it wants to enter India. They are considering

entering the Indian market, and you have been hired to determine whether they should enter the

Indian markets or not.

Interview Transcript

Your client is a leading Electric Vehicle (EV) manufacturer based out of the UK. Due to the saturation in the current markets in which they are operating, they are looking to expand. You are hired to advise them and devise a market entry strategy for them.

To clarify, the client is a leading foreign electric vehicle manufacturer, currently operating in the UK. As a result of the current markets reaching a point of saturation, the client wants to expand to new markets and I have to advise them.

Yes, that sounds right.

I would first like to learn more about the client and its capabilities. Also, is there any specific country that they are looking to enter?

With its unique battery switching technology, the client leads the electric vehicle market. With more than 45 years of experience in the industry, it is ranked as the third-largest manufacturer in the world as of 2023. Observing the current government activities in the EV industry, they are aiming to enter Brazil or India, both of which have significant upside potential. They get along well with the government of India.

Also, how is the competitive landscape of both markets?

For India, there are majorly 4 players in the market occupying more than half of the market. For Brazil, the market is fairly competitive with 5 major market players occupying almost the whole market.

Okay, so both markets are highly concentrated and exhibit a similar competitive landscape.

You may start with the analysis.

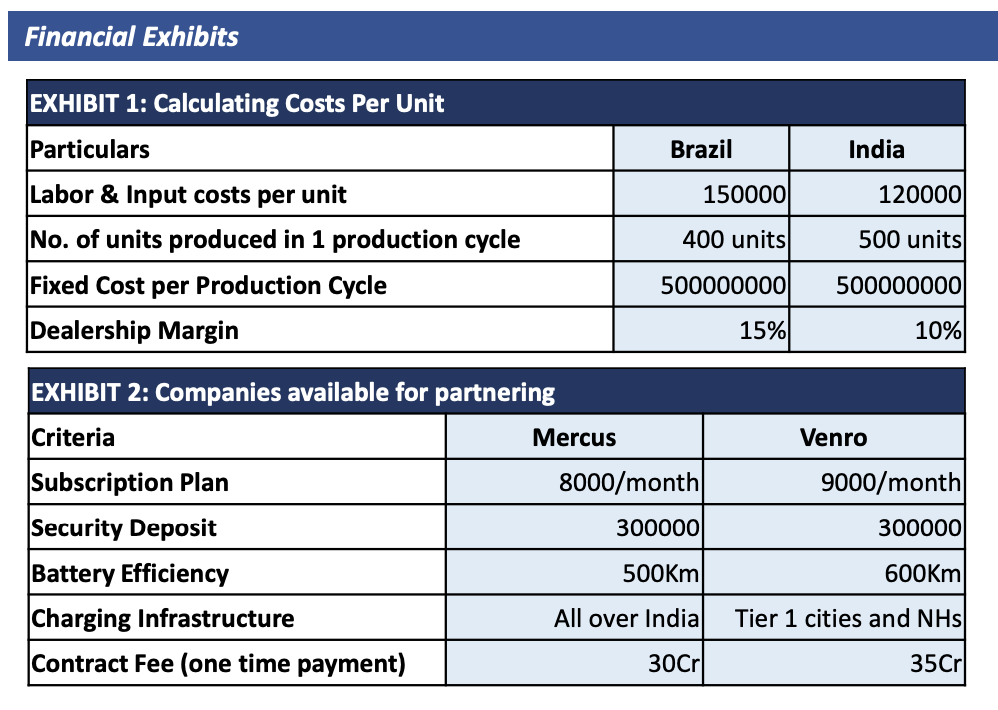

Since any company entering into a new market wants to have a seamless production set up. Is there any data for me to calculate the costs per unit?

Yes, we have the following table (Exhibit 1)

For India:

Using the given information , the cost of production per unit comes out to be 11.8 lakhs [1.2 lakhs + (50 crores/500)]

After assuming a 15% margin the wholesale price to be 12.8 lakhs and adding the dealership margin of 10% the ex showroom price becomes approximately 14 lakhs.

For Brazil:

The cost of production per unit comes out to be 14.5 lakhs [2 lakhs + (50 crores/400)]

After assuming a 15% margin the wholesale price to be 16.6 lakhs and adding the dealership margin of

15% the ex showroom price becomes approximately 19.1 lakhs.

Above calculations show that it is less favorable to enter Brazil as the efficiency in both units and cost within a single production cycle is lower. Close relationships with the government of India further implies no distribution issues as well in India as we can enlist their help in obtaining access to third party channels.

These are fair points. Now analyze the feasibility of entering India.

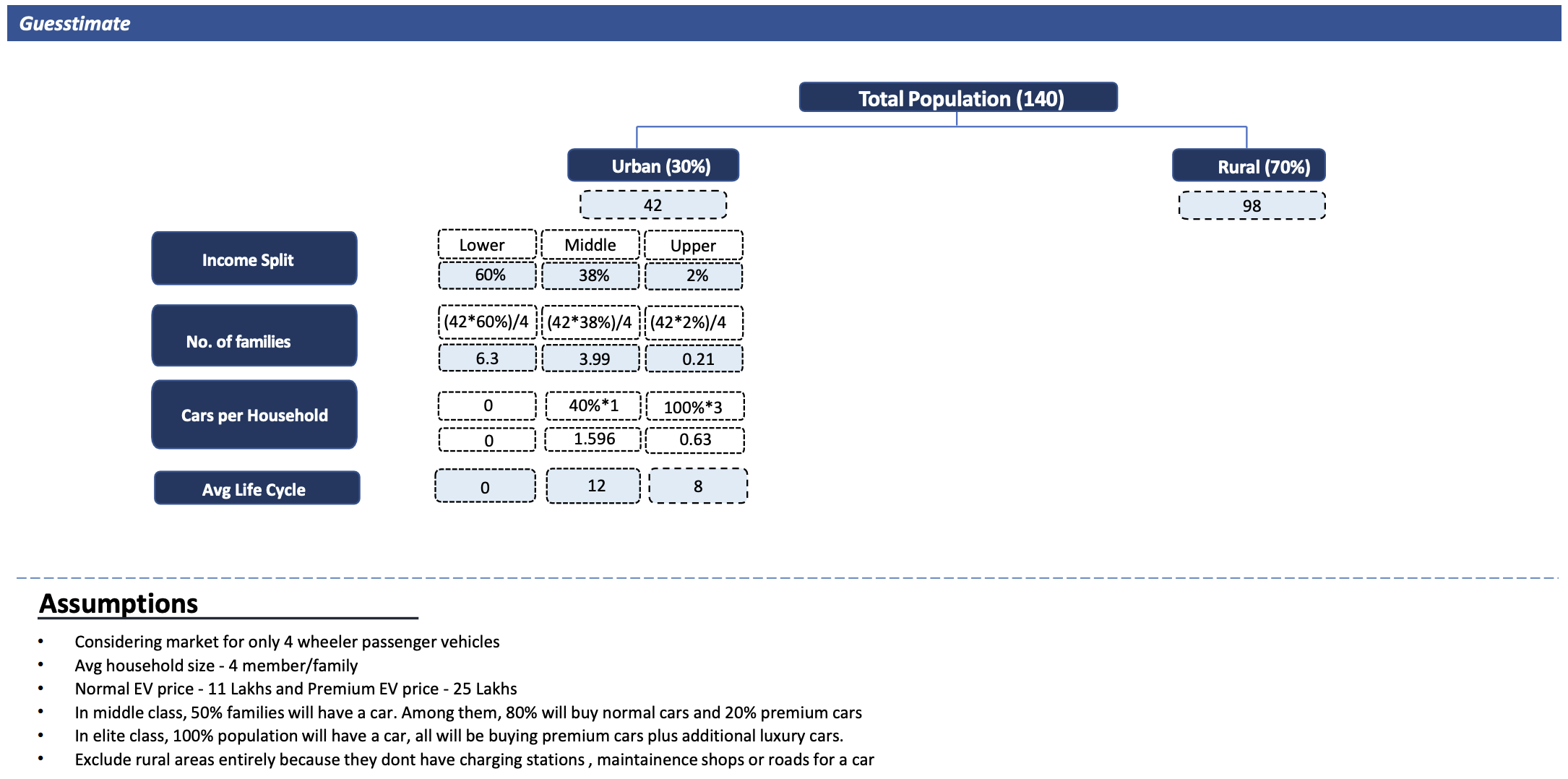

Sure. I’d also like to estimate the profit by multiplying market share with market size and average order value and subtracting total cost. Let’s start by estimating the market size of the 4-wheeler EV market first. Considering the population of India to be 140 crores, further dividing it into an urban-rural split of 30% and 70%, respectively. We will ignore rural areas completely because they lack charging stations, maintenance shops, or roads suitable for cars.

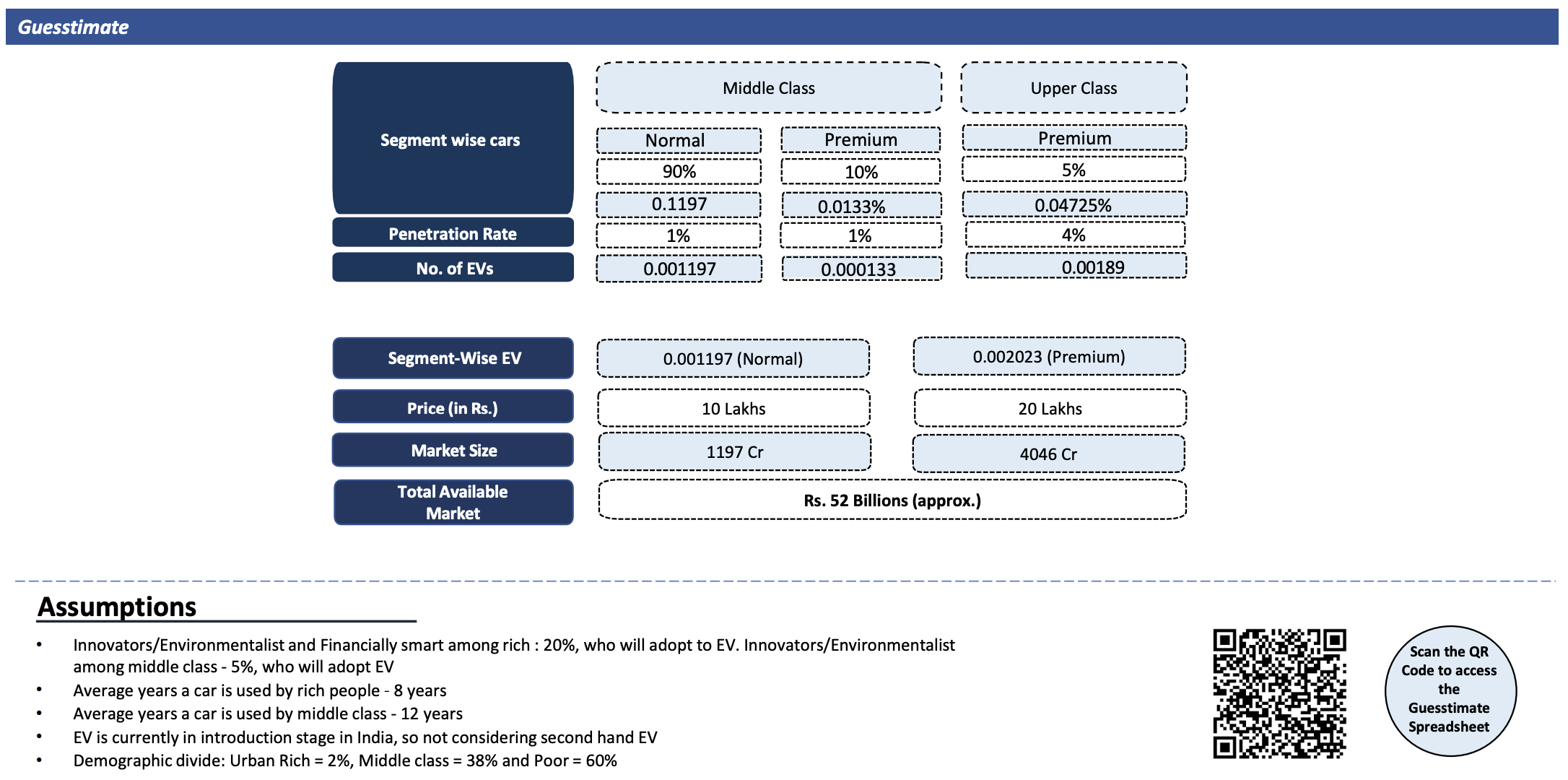

Next, we’ll divide the urban population into lower, middle, and higher income groups to account for the affordability factor. The division percentages are 60%, 38%, and 2%, respectively. To get the number of households, we will divide by 4. Assuming the average life of a car is 12 years for the middle class and 8 years for the higher income groups, and considering that 50% of the middle class people have cars (usually 1.5 cars per household), of which 10% are premium cars, we arrive at a total of 1.33 lakh cars. Additionally, assuming that 100% of the higher income segment owns cars, with an average of 3 cars per household, out of which 60% are premium and 40% are luxury cars, we arrive at a total of approximately 7.8 lakh cars.

Alright. That sounds good. Let’s continue

Since it’s a new company entering Indian markets for the 1st time it would preferably opt to choose the higher income segments and make cars like sedans to maximize its adoption. We get the number of households with higher incomes as 21 lakhs . As mentioned that top 4 brands have more than 50% share it means that its a highly concentrated market, its safe to assume that these brands must have captured the high income consumers first. So, given the exclusive battery swapping technology I am assuming 3% of the higher income consumers. The average order value of an EV is around Rs. 20 lakhs, while the battery swapping technology could reduce the upfront cost by 20% thus decreasing the average order value to 16 lakh and increasing the projected market share to 5%. By using the above calculated figures, the annual profit comes out to be 120 crores. Is it viable for the client to enter?

Yes, that seems feasible. Can you now devise a strategy to enter the market?

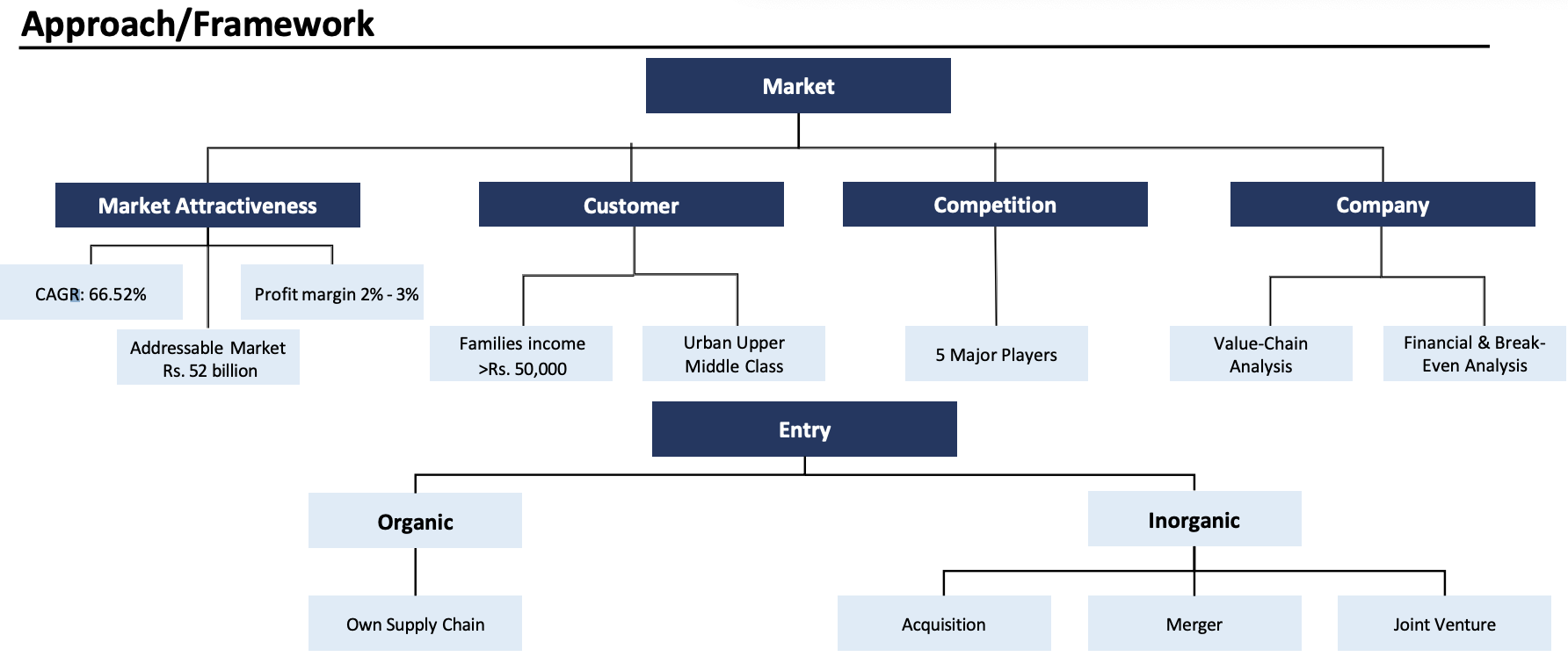

Sure. The client can consider both brown field (inorganic) and greenfield (organic) strategies. Is there any information available for me to make my choice?

There are no companies that the client could acquire. There are two Battery as a Service (BAAS) companies that they can joint venture with.

After analyzing the manufacturing cost and the market for EVs in India, the company should prefer to establish its own production units, thereby entering the EV market organically. Additionally, as there are no companies available for acquisition, I recommend entering into a contract with either of the BaaS (Battery as a Service) companies. The contractual agreement is preferred because otherwise, the company would have to set up a battery-swapping infrastructure in India, incurring a significant cost. Is there any information available to decide which company to partner with?

There is some data available to make a choice. (Exhibit 2)

After evaluating the metrics quantitatively and qualitatively, the major factor to consider is the subscription cost because there is no additional charge for switching the battery. So, even though Mercus provides batteries that offer less mileage than Venro, the availability of swapping stations reduces range anxiety. The subscription model of Mercus is more user-friendly for both opting in and opting out. Thus, both quantitatively and qualitatively, Mercus seems to be a better option for the company.

Sounds good. Is this all you want to consider?

I’d like to conclude by doing a break even analysis to see how long it will take for the company to make profits?

Brilliant. What is the data that you would require?

Based on the provided data about the fixed cost, selling price and the variable costs the client needs to sell 428 units per production cycle to break even.

Do you have any recommendations for the client?

I have a few recommendations for the client:

The client should initially enter through the contract, but over the years, they should strive to establish their own battery swapping infrastructure to maximize profits. Additionally, the company should explore entering the hybrid electric vehicle (EV) technology, similar to what is found in the Hyundai Kona, as it has experienced significant adoption.

Alright. We can close the case here.

Case Facts

- Overview: EV manufacturer based out of UK who wants to enter new market due to the saturation of the current markets in which they are operating

- Battery swapping technology exclusively and third largest manufacturer in the world

- Excellent relations with Govt of India

- Industry Scenario: Fairly competitive with 4 major players occupying the market

Approach

Case Recommendation

- To build their own battery swapping infrastructure in the years to come

- To keep experimenting with emerging technology like the hybrid EVs.

Brownie Points

- The consumer doesn’t have to pay for the battery for when he is not using the car for months.

Guesstimates

Financial Exhibits