consulting the OGs

Case Statement :

You’re working as a consultant in a leading management consulting firm. The firm is facing a

decline in profit margins. How will you approach this problem?

Interview Transcript

You’re working as a consultant in a leading management consulting firm. The firm is facing a decline in profit margins. How will you approach this problem?

To reiterate, I’m working as a consultant in a leading management consulting firm and it is facing a decline in profit margins. I am required to analyze why and suggest solutions.

That’s correct. You can proceed.

Before starting with the case, I would like to know more about the firm. How long has the company been operating and what is the quantum of this year on year (YoY) decline in profitability?

The company has been operational since 2014 and is 10 years old now. The company hasn’t been able to achieve its profitability target of 20% for the past 3 years.

May I know the composition of the clientele of the firm and its area of operations?

The clientele of the firm is diverse since it offers 9 different industry verticals. The firm has pan-India operations with its headquarters set up in Gurugram, Delhi.

Is this problem being faced by the entire industry or is it specific to our firm only?

The problem is faced by our firm, the rest of the industry is performing well.

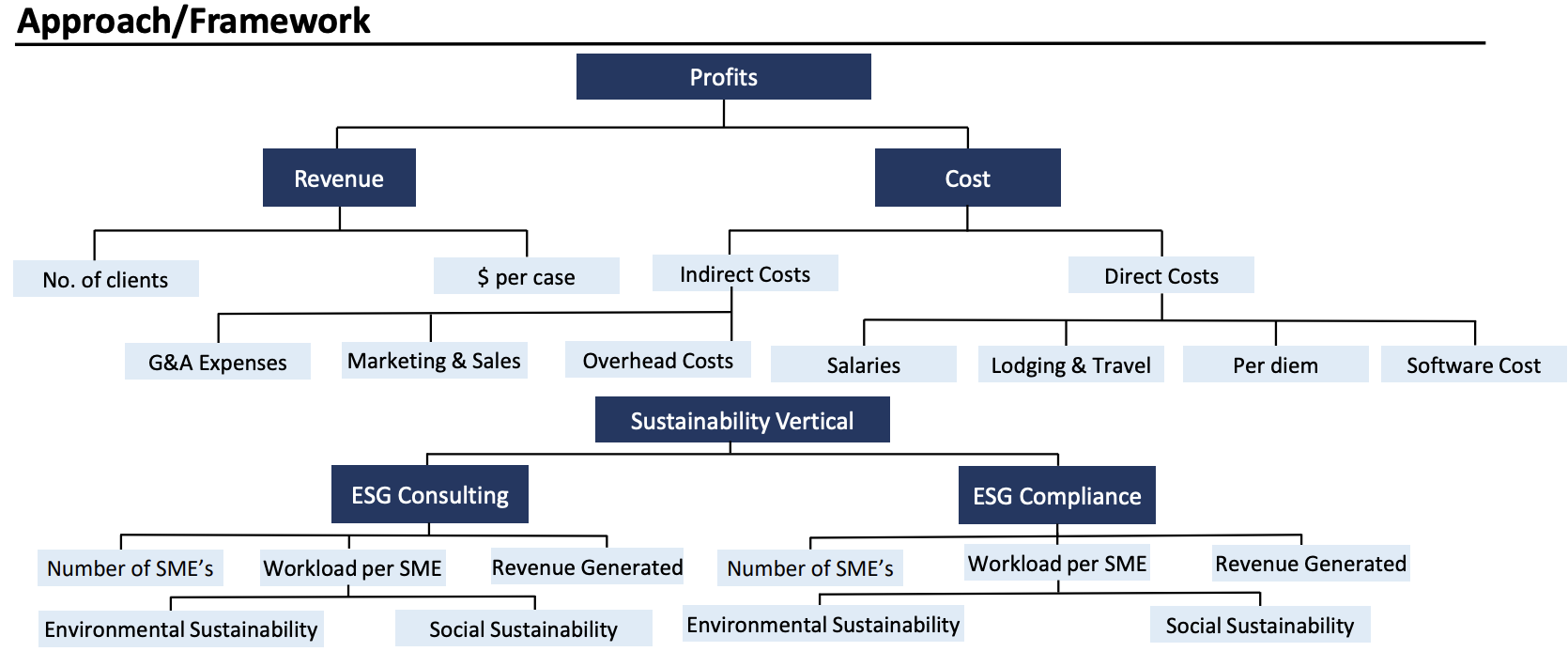

We know that profits are the difference between revenue and costs, so is there any data available regarding the firm’s revenues?

No. We do not have financials about the revenue or costs at the moment. I would urge you to present your approach now.

Okay, so there might be internal and external reasons. By internal factors we mean the factors which are present within the vertical while by external factors we mean those factors which are in control of the consulting firm but not in the hands of the vertical individually.

You can divide the factors in this way. Could you enlist some probable factors which might affect our vertical?

Sure, I believe the following might be some of the external reasons:

- Organizational Structure: The way our company is structured can make or break our efforts to deliver results. If we don’t have clear roles between different verticals, then it might be difficult to get work done.

- Corporate Strategy: Our company’s overall game plan can have a big impact on our work. If corporate strategy isn’t a part of our strategic planning, we might find ourselves struggling to make our consulting and compliance efforts effective.

- Budget Allocation: The amount of cash our company is willing to put towards projects can affect our ability to provide top-notch consulting services.

- Training and Development: The firm should constantly strive to up-skilling its employees hard and soft skills such that the firm continues serving clients in spite of any industry-wide disruptions.

The external factors are not the reason. You can now focus your approach on internal factors.

Sure, as far as internal factors go I can think of lack of expertise in our team. If our employees don’t have enough know-how on matters pertaining to our scope of work, the firm may lose its credibility. Also, inadequate resources can be a reason, since an investment in development of resources to aid our consulting efforts is necessary. Additionally, poor communication in presenting our recommendations in an efficient and constructive fashion is a hurdle to the firm’s success. Finally, the internal structure, is the way our verticals are structured can have an impact. An assessment of hierarchy, work division and work load is crucial.

To further delve into the root cause of the problem, I would also like to know if any particular vertical of the firm is facing the profitability issue.

You’ve accurately pointed out the probable reasons. The issue lies in the internal structure of the sustainability vertical.

Can you share some insights about the sustainability vertical – the scope of work, the ideal case team

structure and the other relevant information about the vertical.

The vertical was established 3 years ago when the partners of the firm realized that there was an increasing need for ESG-based consulting and compliance. Hence to cater to that market, they introduced this as a separate vertical in 2021.

So the firm has segmented the sustainability vertical further down or have they kept it as one consolidated vertical?

The firm has segmented the vertical into ESG Consulting and ESG Compliance so that efficient work takes place.

Is there any information regarding the areas where these 2 segments operate and the division of clients between the two segments?

This vertical is further segmented into ESG Compliance and ESG Consulting. ESG Compliance consists of the guidelines and standards the client has implemented in internal policies that are mandated by regulatory bodies and ESG Consulting has a primary focus on providing clarity into the risks and opportunities associated with addressing environmental, social and governing issues for our client firm. The workforce division is 7:3 between ESG consulting and ESG compliance respectively.

Okay, so before going forward I will require the current internal structure that is present. Can you

please provide insight towards the roles and their responsibilities?

Sure The structure is

- Partner: Leads strategic direction, makes key decisions, and ensures alignment towards goals.

- Subject Matter Expert (SME): Provides expert advice and insights in a specific area.

- Associate: Supports the team to draw insights from primary and secondary research and inform

decision-making.

- Analysts: Conducts day-to-day tasks such as research, report preparation, and client support.

- Backend Support: Ensures seamless operation of systems and processes.

Thank you for this information. This makes the picture more clear. Is there any data provided for the case arrangement and allocation for the roles in the two segments?

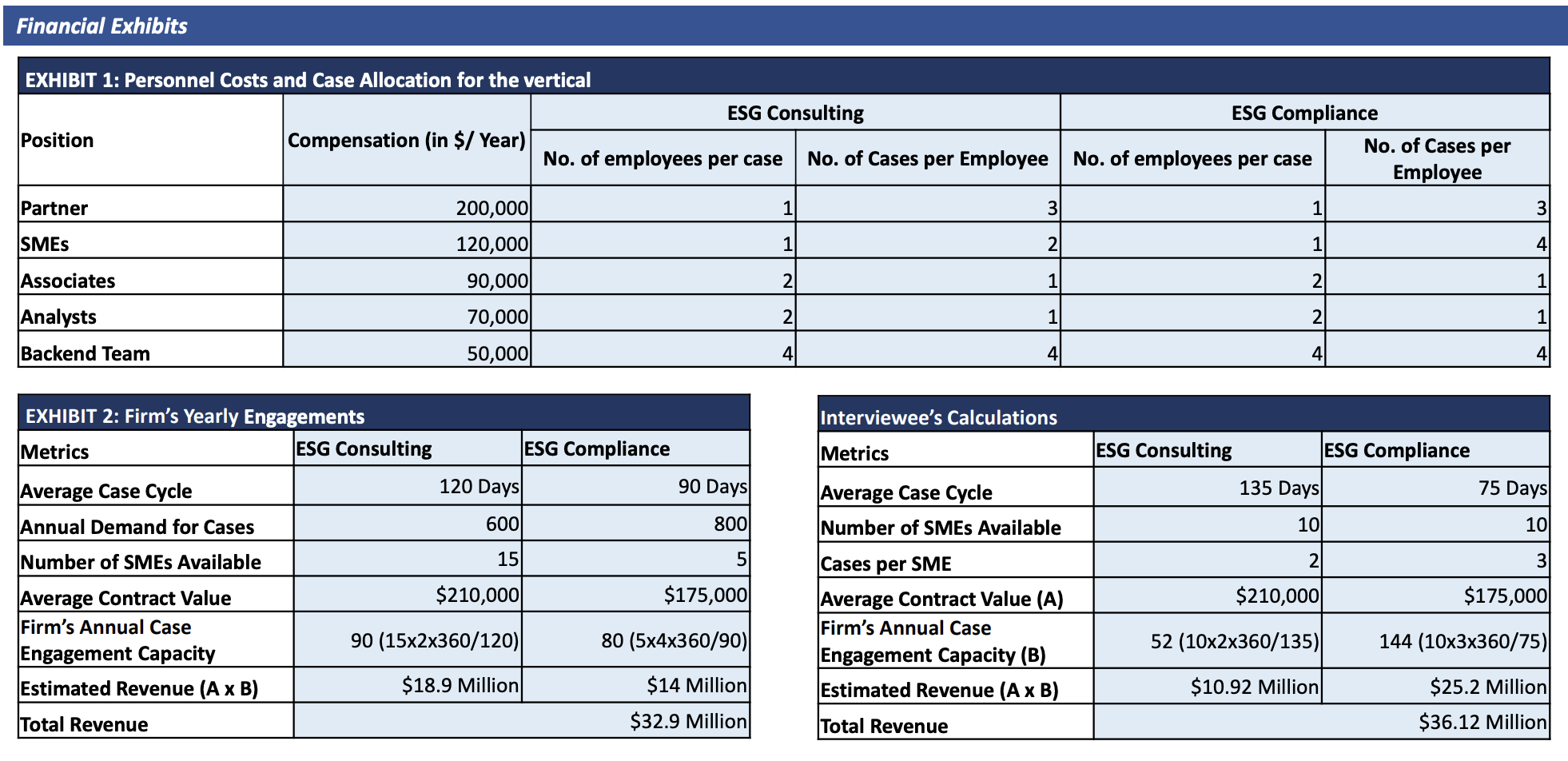

Yes, there’s a table showcasing the personnel costs as well as the case allocation for both ESG Consulting & ESG Compliance. (Please refer to Exhibit 1)

Upon inspection, I was able to analyze that the Subject Matter Experts in the two segments share a different workload and in fact there’s altogether a different number of SMEs present. The ESG Consulting vertical has 1 SME working on 2 cases at a given time, while the ESG Compliance vertical has 1 SME working on 4 cases at a given point in time. This leads me to believe that there’s a significant imbalance in the workload between the SMEs in ESG consulting and those in ESG compliance which is leading to inefficiencies. According to the exhibit, 1 SME is working on 4 cases and is shouldering a heavier burden.

Yes, that’s accurate. Apart from this can you identify any potential problems which might occur from this structure?

I would like to assess the Average Case Cycle, Contract Value and Yearly Cases taken up by the ESG verticals. Do we have any data for the same so that I can synthesize effective recommendations?

Following is an exhibit with data on firm’s yearly engagements. (Please refer to Exhibit 2)

Thank you for the data, do we have any insights on the variation in the case cycle (time taken for 1 case) for ESG Compliance segment if more SME’s are introduced in the vertical and any significant increase in case cycle if SME’s are withdrawn from ESG Consulting? Using the above, I would calculate the revised Annual Case Engagement using the formula = SME’s x No. of Projects Completed by 1 SME per case cycle x Number of periods per year relative to Case Cycle. The existing Annual Case Engagement stands at 90 cases per year (15x2x360/120) for ESG Consulting and 80 cases per year (5x4x360/90) for ESG Compliance.

Introduction of 1 new SME into the ESG Compliance segment would reduce the Average Case Cycle by 3 days. Simultaneous reduction of the same SME from ESG Consulting will cause an increase in Case Cycle by 3 days. Altering cases per SME to 2 and 3 would be ideal. Please present your solution now.

I would recommend restructuring the firm’s sustainability vertical which would help in redistributing the workload from ESG consulting SMEs to ESG compliance SMEs. This would help in balancing the workload and reducing the burden while also ensuring that the costs are lowered. By redistributing some of the workload from the consulting SMEs to the compliance SMEs, we can optimize our operations. My calculation shows that the current revenue of the firm at maximum capacity stands at $32.9 Million. If a total of 5 SME’s are shifted from the ESG Consulting to ESG Compliance while altering case’s per SME to 2 and 3 respectively, the Case Cycle for ESG Consulting would stand at 135 Days and 75 Days for ESG Compliance. The rationale behind shifting only 5 employees relates to the assumption that the company wants both of the ESG segments to be competitive and scaling the ESG Compliance segment is not at the cost of losing out market share to competitors. Further, the ESG Compliance segment’s Annual Case Engagement Capacity would grow to 144 cases per year (10x3x360/75) while it will reduce to 52 cases per year (10x2x360/135) for ESG Consulting. However, these recommendations would elevate the firm’s revenue to $36.1 Million, a net increase of $3.2 Million or 9.72%.

That is a very comprehensive analysis. Do you have any other suggestions for the firm?

- Continuous Learning and Development: Encourage continuous learning and development among SMEs. This can help them stay updated with the latest trends and best practices in ESG consulting and compliance.

- Regular Review of Workload: Conduct regular reviews of workload distribution to ensure it remains balanced. This can help identify any imbalances early and take corrective action promptly.

Thank you for the suggestions. We’ll wrap the case here.

Case Facts

- Overview: Consulting firm facing declining profits

- 9 different verticals in the firm

- Industry Scenario: Problem specific to the company

- Period of Decline: 3 years

- Change in regulation: None

Approach

Case Recommendation

- Restructure the sustainability vertical

- Reallocate the Subject Matter Experts from ESG compliance to ESG consulting

- Redistribute Backend support to strike a balance between the segments

Brownie Points

- Identification of internal structure to be a probable reason

- Understanding the hierarchy of the vertical

Financial Exhibits