Coalect

Case Statement :

Your client is a steel manufacturing company looking to buy a coal mine. You’ve been onboarded as a consultant, and the client wants you to find the maximum price they should be willing to pay for the coal mine.

Interview Transcript

Your client is a steel manufacturing company looking to buy a coal mine. You’ve been onboarded as a consultant, and the client wants you to find the maximum price they should be willing to pay for the coal mine.

Okay, so to begin with, I would like to know the objective of the company for purchasing the coal mine.

Sure. Our profit margins are quite low because of high costs, so as a cost-cutting measure, we wish to purchase a coal mine so as to be able to procure coal for the steel manufacturing process at a lower price.

Can you please tell me what the current status of the company and the industry is like? What are the profit margins of the company, and what are the industry average profit margins?

For the last financial year, we had profit margins of 15% in comparison to an industry average of 20%.

Also, how does the company plan to use the coal extracted from the mine? Will the company be using the coal extracted from the coal mine only for internal use in production?

No, the steel producing plant has enough production capacity to only be able to use 50% of the produced coal at any point in time, so the remaining coal shall be sold in the market.

What will be the selling price of the coal? Also, does the company have an expected profit margin it would like to reach while selling coal?

The coal will be sold in the market at Rs. 35,000 Per metric tonne. Yes, we would like to have a profit margin of 15% from the sale of coal.

Now I would like to analyze the details of the coal mine. So, what is the estimated quantity of coal that is expected to be present in the coal mine?

It is only known that the coal mine is in the form of a cylinder, 100 meters deep, and has a radius of 2 meters. It is also known that the average amount of coal that can be extracted from other coal mines in the area is 0.5 Metric tonnes per 1-meter cube of the volume of the mine.

So, if we estimate the total amount of coal in the mine, it comes out to be approximately 628 metric tonnes. How much time do you think will be required for complete extraction?

It is estimated to be three years

So, we can have approximately 200 metric tonnes of coal extracted per year available. Now, I would like to estimate the financials and profits associated with the coal mine. Since we are planning to sell 50% of the coal in the market, we will be making a revenue of Rs. 35,00,000. At 15% margin on profits from this sale, our target profits come out to be Rs. 5,25,000 per year

So what do you think can be the allowed total cost of coal as per sale estimates?

Looking at the revenue and expected profits from the sales, the total cost allowed for coal per year is Rs. 29,75,000. Furthermore, for 50% coal extraction, the cost is Rs. 25,00,000. One-third of the purchase cost of the coal mine can be obtained by subtracting the extraction costs from the total allowed costs. So, 1/3rd purchase cost of the coal mine comes out to 4,75,000 and the maximum purchase cost of the coal mine we can have comes out to be Rs. 14,25,000.

Great. But we are going to use the extracted coal in the steel plant as well. So, how would you estimate the maximum price of the coal mine as per the target profits of the steel manufacturing plant?

Okay, so may I know how much revenue is expected from the steel manufacturing plant and what profit margins are we targeting this year?

Both. We have estimated to have revenues up to Rs. 10 crores and expect to have a 20% of target profit margin for this financial year.

Clear. So, this means we can have a maximum of Rs. 8,00,00,000 allowance for all our costs. How much do you think will be our costs just for the steel plant?

You may assume that we incur Rs 7,70,00,000 operating our steel plant.

Okay. That means we can have a maximum of Rs. 30,00,000 to spend on the coal mine. For 50% of the coal extraction, we will have to spend Rs. 25,00,000. So, we will have Rs. 5,00,000 left to spend on the coal mine. Again, assuming that approximately one-third of the purchasing cost of a coal mine is covered by this amount, the maximum purchase cost of the coal mine we can have comes out to be Rs.15,00,000.

Great. So, what would you recommend in this case?

Keeping both figures in mind, I’d recommend that the steel plant should be acquired for a maximum cost of Rs. 14,25,000. This will ensure that the client is able to gain a profit of 15% on the sale of coal and increase the profit margin of its steel manufacturing plant to 20%.

Thank you for this strategy, I believe we can end the discussion here.

Case Facts

- The existing profit margins of the company are 15% (quite low).

- The company plans to use the coal extracted in two different ways: direct sale in the coal market and for manufacturing steel.

- One-third of the purchase cost of the coal mine can be obtained by subtracting the extraction costs from the total allowed costs.

- The target profit margins of the company after purchasing the coal mine are 20%.

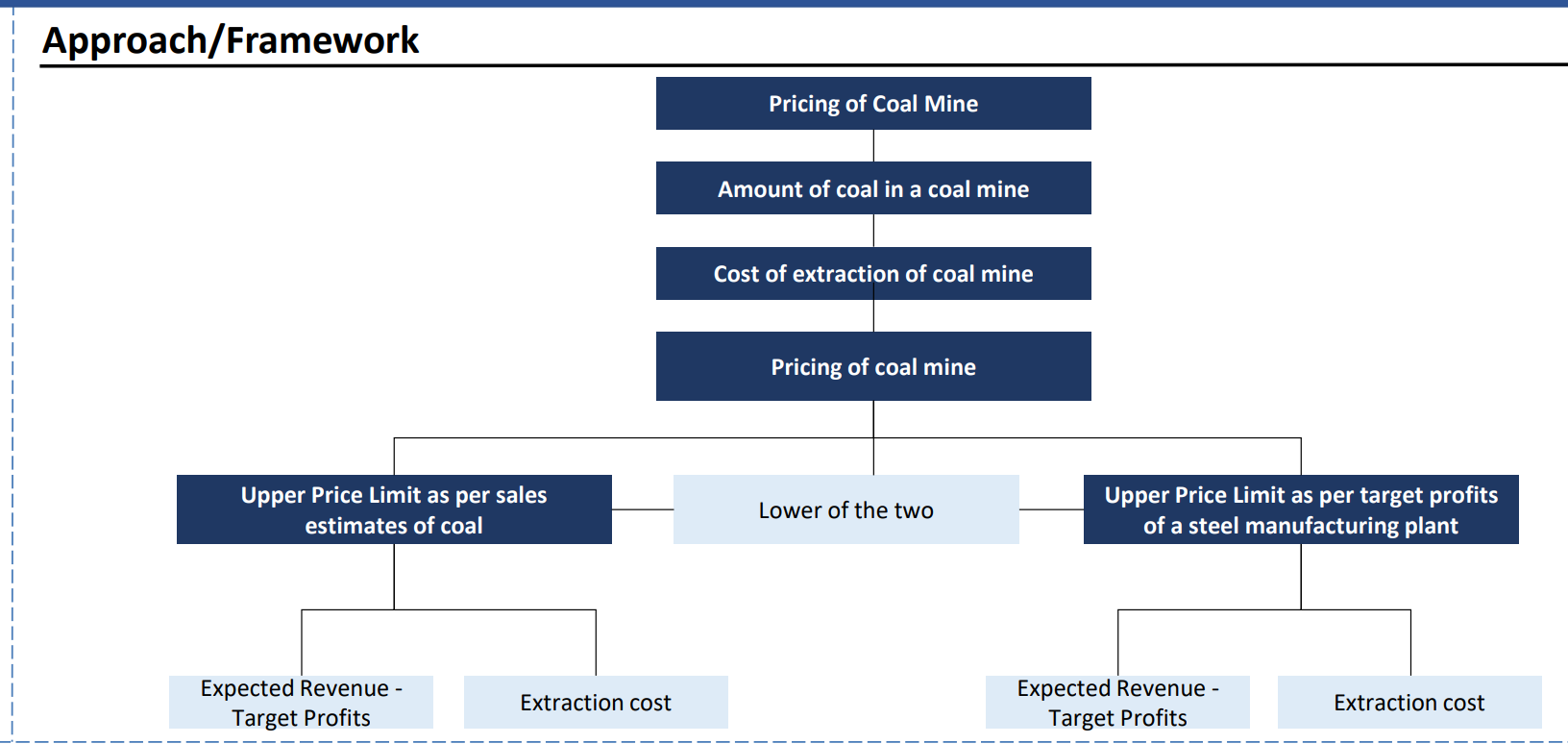

Approach

Case Recommendation

- The maximum purchase cost of the coal mine as per sale estimates of coal comes out to be Rs. 14,25,000.

- The maximum purchase cost of the coal mine as per the target profits of the steel plant comes out to be Rs. 15,00,000.

- The lowest upper limit to purchase the coal mine comes out to be Rs. 14,25,000.

Brownie Points

- Having prior knowledge of the industry

- Ability to comprehend and solve the financials.

Financial Exhibits