Race to TV

Case Statement :

Your client is a popular OTT broadcasting company wishing to broadcast F1 in India on an exclusive platform, determine the maximum amount they can bid to gain the broadcasting rights.

Interview Transcript

Your client is a popular OTT broadcasting company wishing to broadcast F1 in India on an exclusive platform, determine the maximum amount they can bid to gain the broadcasting rights.

Alright sir. Can I know more about the client? How many years have they been operating for and what are the goals that they are planning to achieve from the deal?

The client is streaming all kinds of live events and sports from around the world. They have been operating in the market for 6 years. Seeing the growing popularity of F1, they wish to enter the markets that are largely untapped and showcasing great viewership potential. They have identified the Indian market and want you to analyze if an investment would be fruitful. The company is looking to generate a profit of 25% from streaming F1 after taking into account all costs including the investment made.

How is the client looking to stream the races. Will it be through their already existing platform?

They are currently planning to launch a platform specifically for F1. There are reports that a competitor might bid close to 2 billion dollars (1662963 lakhs) for the global broadcasting rights of F1.

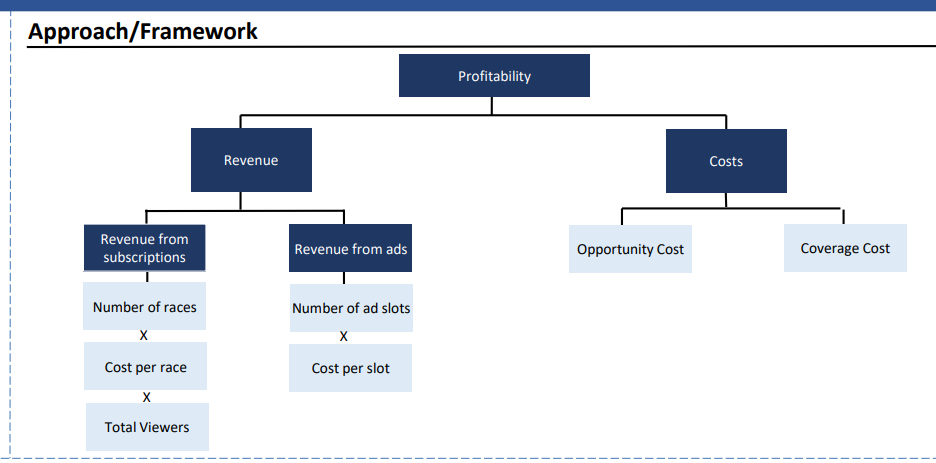

Alright sir, I’ve noted the essentials regarding the case problem, please allow me to have some time to gather my thoughts and frame a solution. Since the company wants to maximize the profits, I’d like to explore the revenue and costs attached to it, separately.

Looks good, go ahead

Beginning with the revenue side, there are primarily 2 major streams of revenue — advertisements and subscriptions. Advertisement revenue can further be shown as a multiple of total races in a year, duration of ads in a normal race and the cost of an ad. Do we have any data relating to this?

Yes. 20 races per year of 120 mins on an average are expected. Advertisements are shown via split screen during the match and other ads before and after the race. A ten seconds ad generates close to 6.5 lacs in revenue.

Alright. So the duration of ad per match can be estimated as 1260 seconds or 21 mins. This number has been taken by assuming that a fifteen seconds ad is shown via split screen after every 5 minutes on an average.

A total of 15 minutes ad is run right before and after the match which is attributed to the revenue from the race

. These figures yield Ad revenue of about 20160 lacs.

[15 seconds * (120 mins/5 mins)] + [15*60]

= [360 seconds + 900 seconds]

= 1260 seconds

Next I would like to approach the subscription angle. This majorly includes the number of races, average viewership, and cost to stream a race. Is there any information available about the last 2 factors ?

The industry trend suggests the cost of one race for a viewer is Rs. 50. As for the viewership, I’d like you to do an estimation for that number.

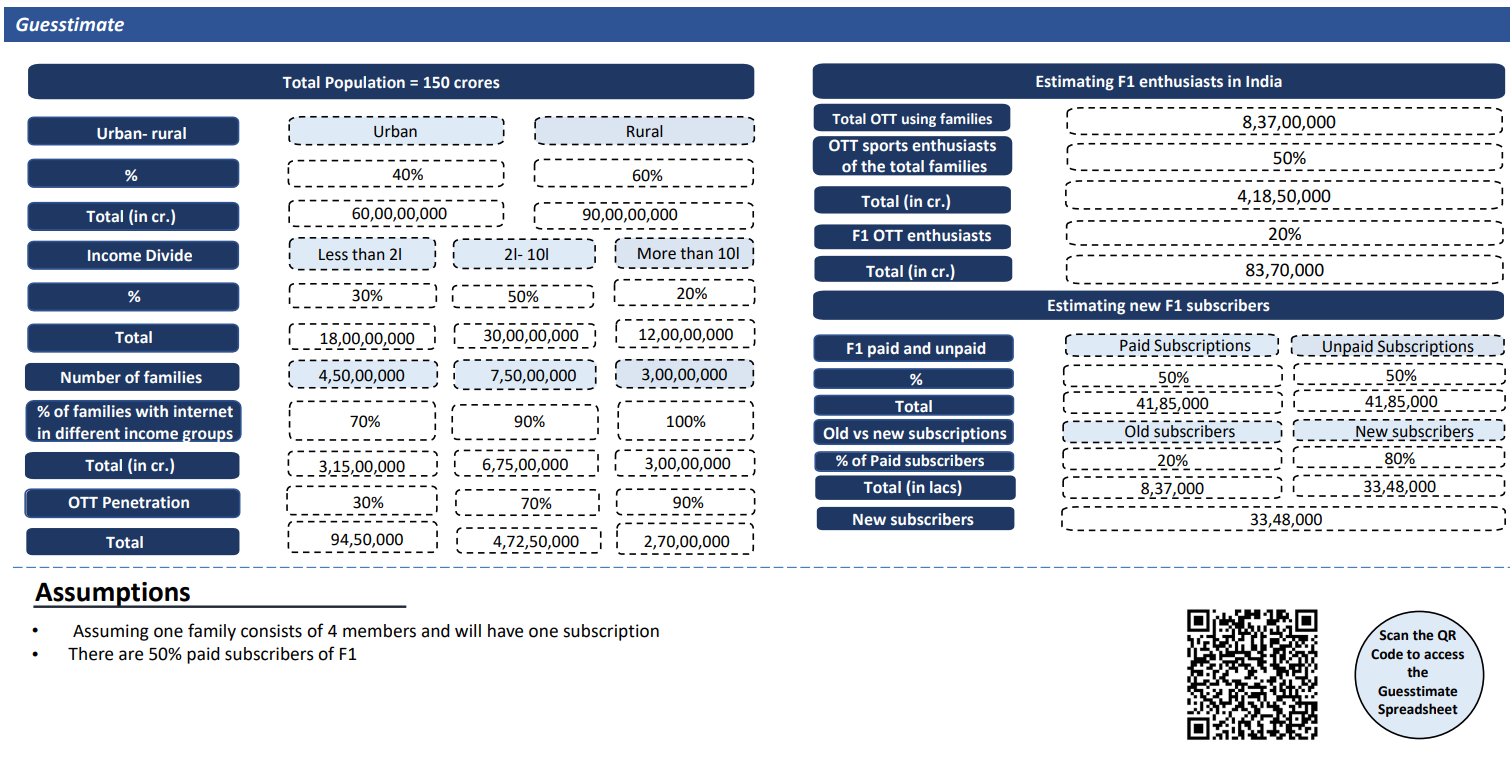

Well I will begin with assuming the total population of the country to roughly be about 150 crores. Establishing an urban-rural divide with 40% and 60% respectively. Moving forward I’ll segregate the population based on the income categories they fall under since a subscription model has to be followed. We will also take in account the Internet and OTT penetration assigning logically assumed percentages, a large proportion of which would be taken up by the middle-to-high income groups. Furthermore, we will proceed with estimating the total F1 OTT enthusiasts in India which come out at around 83 lakhs.

Considering the likeliness of unpaid and paid subscriptions, we assume a rough percentage of about 50% paid subscribers. Giving a consideration of 80% to the new subscriptions to OTT against the already existing ones, gives us approximately 33 lakh subscribers.

Taking that into account we can say that the revenue from subscriptions is 33000 Lakhs.

[(Viewers/race * Number of Races) * Cost per Race]

[(33 Lakhs * 20) * 50]

[33000 Lakhs]

So, our total revenue is 53160 Lakhs.

[Ad Revenue + Subscription Revenue]

[20160 Lakhs + 33000 Lakhs]

[53160 Lakhs}

Great. Please analyze the costs which will be incurred.

Sure. There are two major costs apart from the bidding cost, the coverage costs and the opportunity costs. Do we have any data about these?

The coverage costs are 26980 Lakhs. The opportunity cost can be assumed to be 30 Lakhs/min.

Alright. So the total opportunity cost will be around 12600 Lakhs (20*21*30), considering the cost per hour multiplied by the total ad duration in a year. Total ad duration has been calculated by multiplying total races in a year i.e. 20 and ad duration per match i.e. 1260 seconds or 21 minutes. With the coverage costs being 26980 Lakhs, The total costs associated with the broadcasting will be 39580 Lakhs.

Therefore, the profit for one year can be estimated at around 13580 Lakhs.

Do we have any information about the duration of the agreement and when exactly is the bid made?

Good Question. The bid is made one year in advance. And the deal is for 3 years post which the contract may or may not be renewed.

So the profits calculated above need to be discounted to the present value and also the future value of the profit needs to be calculated. What is the cost of capital prevalent in the industry?

Take cost of capital as 10%

Based on this, the profits for the 3 years can be estimated as follows — 12345 lakhs, 13580 lakhs and 14938 lakhs respectively. The total profit for the 3 years is 40863 lakhs.

Were any assumptions taken when considering the 3 years?

So, it can be said that the opportunity cost remains constant for the 3 years and is in comparison with an investment in the broadcasting rights of any other sport for a similar time frame.

Okay. Is there anything left?

Oh yes! Lastly the company was looking to retain 25% of the profits. So the total bid amount should be 75% of 40863 lakhs, which comes out to be 30648 lakhs.

Offer your final recommendation to the company.

So based on my approach and the above estimates the company can bid anything equal to or lower than 30648 lakhs in order to meet its objectives. A bid above that price may require the company to reduce its expected rate of return from the broadcasting.

Great Job. It was a nice case. Thank you

Thank you!

Case Facts

- Client is a sports broadcasting company.

- Want to bid for the broadcasting rights of F1 in India.

- Planning to generate a profit of 25% from such a bid over an agreement period of 3 years.

Approach

Case Recommendation

- • The company should bid lower than 30648 crores to broadcast F1.

Brownie Points

- Question regarding the time of the bid and the duration of the agreement.

- Guesstimate for the estimation of F1 viewership in India

Guesstimates