Loaded Entry

Case Statement :

Your client is a Tech-based logistics startup on Series-B funding, currently operating in 2 Indian states, looking to grow into 3 more states. You are required to devise a go-to-market strategy, along with the factors that should be considered for state selection.

Interview Transcript

Your client is a Tech-based logistics startup on Series-B funding, currently operating in 2 Indian states, looking to grow into 3 more states. You are required to devise a go-to-market strategy, along with the factors that should be considered for state selection.

I would like to ask a few clarifying questions as I’d like to understand more about our client before I begin to analyze the case.

- In what geography is the client currently operating?

- What type of logistics services does the company provide?

- What is the market share of the company in the industry?

- Are the services B2B or B2C?

The client is working in 2 south Indian states, Kerala and Tamil Nadu. The client currently provides truck-based logistics services. I would like you to calculate the truck-based logistics market size in India and then we can get back to this question. The client provides logistic services to the businesses, for example, transportation of raw materials, machinery, etc.

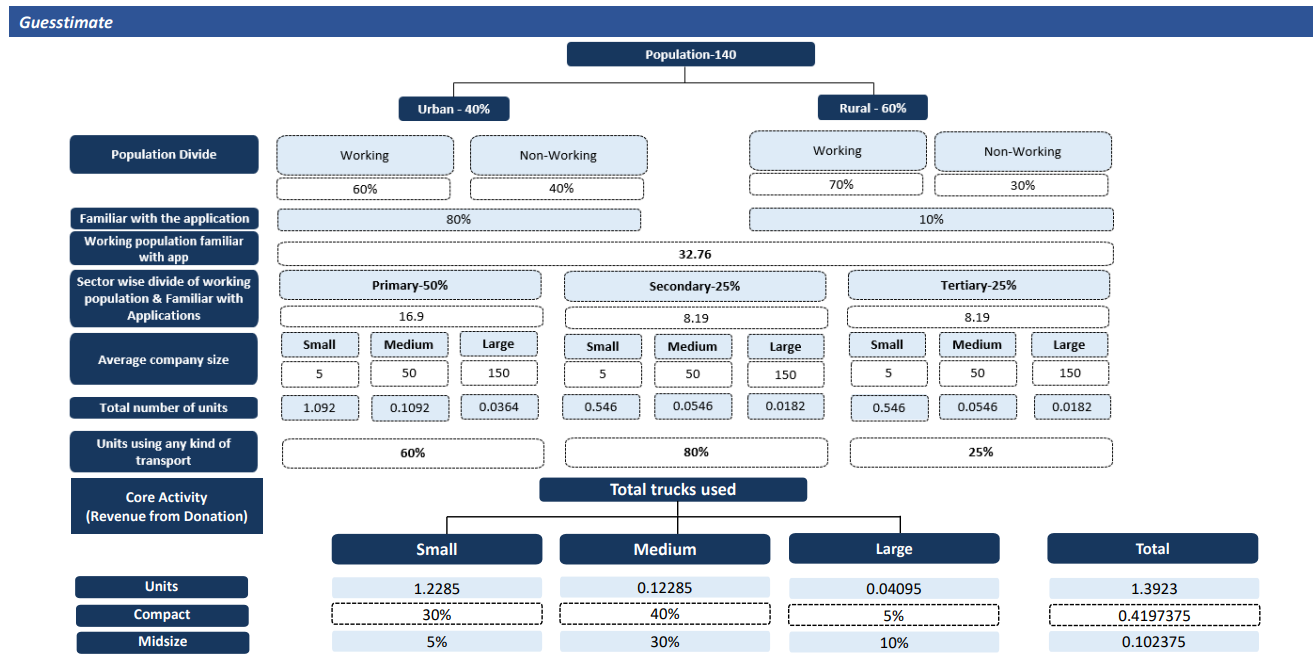

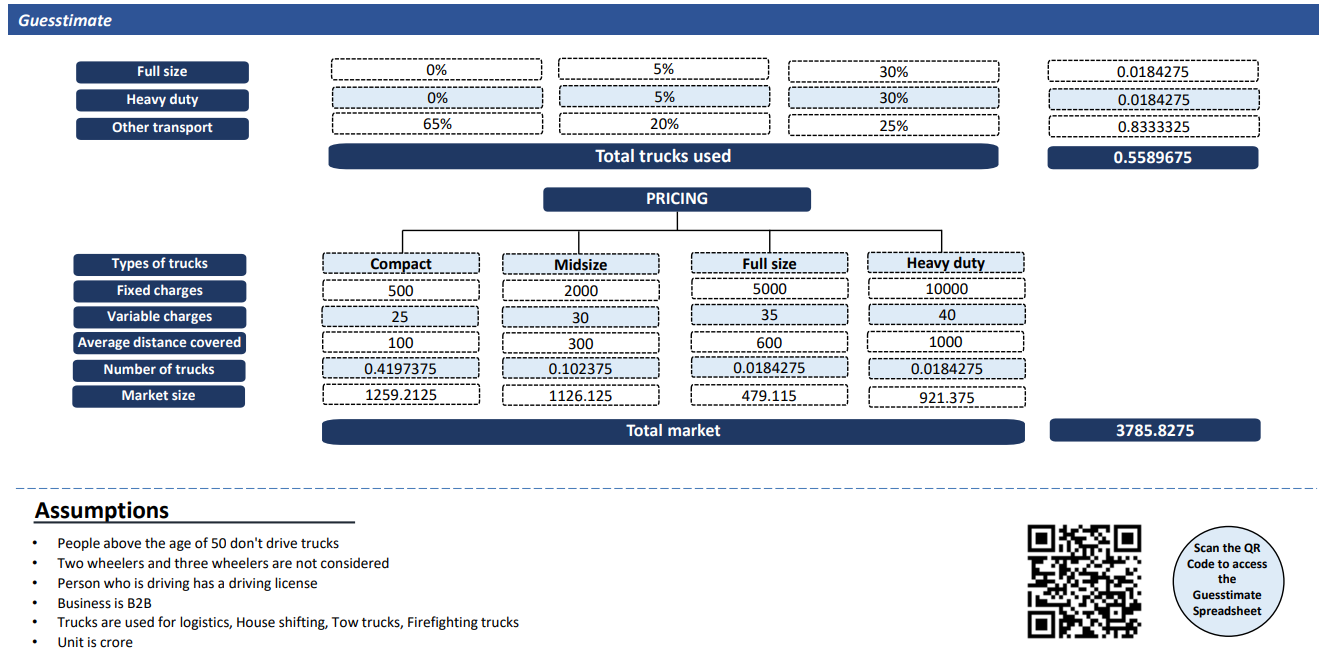

Ok so I will start by calculating the total truck-based tech logistics services in India. My approach will be to calculate the total number of units in different sectors of the country. After that, we will calculate the units using any kind of transport for logistics. (refer to guesstimate)

Yes, that’s a good number

What information do we have on the dominant players in the market as well as the market share of our company?

The market is very fragmented; thus, no player holds a dominant market share as of now. Right now, we have an annual revenue of 50 crores with 20% EBITDA margin

Ok sure. Before that can you please elaborate on the features of the application through which a customer can book a truck? What is the pricing model adopted by the company?

The application has basic features, the customer can open the app and choose the type of truck as per convenience. Once the truck is booked the driver approaches the location and delivers the goods. The company has fixed charges as well as charges per km based on the truck category.

Further I would like to know:

1.What type of companies are the major competitors?

- Is the client thinking of expanding to B2C?

Direct competitors are Truckky, Wheelseye and Porter. Also, there are some unorganized players in the market. No, the client wants to be in B2B only. Can I take 30 seconds to make a structure?

Sure

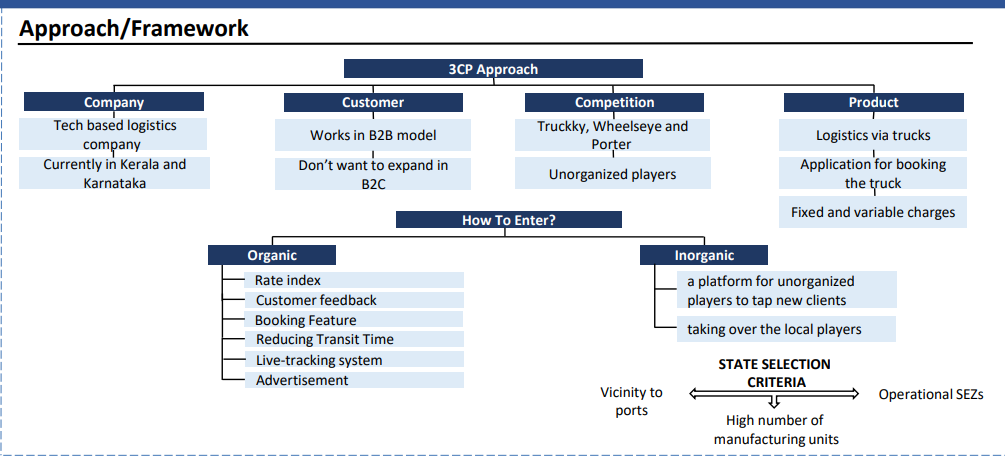

So for the growth aspect I would like to suggest some changes in the pricing model as it will help with flexible pricing and increase the attractiveness towards the company which leads to growth of the company as well as the transit time. Then some ways for organic and inorganic ways to grow.

Ok start with the suggestions for the pricing model.

Since live pricing turns out to be the prominent USP, the customers would be able to find the real time price update on the app now they search for a specific itinerary. This provides an estimate to the customers about the fair price which is updated on regular intervals and is calculated based on the model of the truck, its features, weight of the freight, the distance that must be covered etc. Another important feature to consider is the Rate index for the truck drivers which is calculated as the total of the rate that is coated on the load, fuel surcharge pricing as well as an additional fee for detention, multi-stop charges, driver unload, lumper fees

etc. Such a rate index should be easily visible and accessible to the customer through the app.

Alright, what additions can the company make to enhance the existing USP?

There are some main points for the customers while initiating the request, following factors could be considered to update the application and to enhance the existing USP:

- Customer feedback

- Hassle-free booking feature

- Reducing transit time as compared to typical operators. The reason why one would choose a techbased logistics firm is if it offers perks over other operators and therefore transit time is a big factor considered by companies while doing so.

- Providing a live tracking system – The introduction of such a system where customers can track the vehicle and get live support through chat in case of any modification and assistance would help to bring in more ease and transparency in the processes of route planning, real-time tracking and reliable documentation and control, among others.

Alright, what strategies do you suggest that the company should employ to expand/grow?

The company should enter the market by acquiring local and unorganized logistics providers. The client can do it in two ways:

- By providing a platform for unorganized players to tap new clients.

- By taking over the local players and providing services to their clients

Other Techniques I’d like to suggest would be:

- Offline

- Advertising the company on all the trucks owned by the company

- Advertisement hoardings

Fair enough. How do you plan on selecting the three states for expansion?

3 potential states to be considered for expansion can be selected by keeping in mind the following criterion: State Selection Criteria:

1.The state which has a high number of manufacturing units.

2.States which are near to Ports as the logistics are used to transport products from units to the ports.

3.The state with operational SEZs.

Alright, How would you go about that?

Since we’re already operating in two south Indian states, we have a pre-established inventory, equipment and customer base. To take full advantage of potential operational synergies, I suggest that we expand into the states that lie in the vicinity of our current operations. So, we can narrow down the major states according to the above criterion:

- Karnataka

- Andhra Pradesh

- Telangana

Please state specific reasons for each state, beginning with Karnataka

Karnataka has a vibrant automobile, agro, aerospace, textile and garment, biotech, and heavy engineering industries, also it houses an attractive mining sector. It is home to many operational SEZs as well. The prevalence of the manufacturing sector and the existence of SEZs illustrates a need for truck-based logistics services here.

And what about Andhra Pradesh?

The proximity of ports in Andhra Pradesh provides a window for a logistic company to set up its operations here. Most Coal-based power plants in the country are located which as well would require a logistics infrastructure as well. Key industrial segments including Biotechnology, Bulk drugs, Pharmaceuticals, textile and automotive industries all comprising the target market of the company are also present here.

Okay, Go for Telangana next.

Telangana is a hub of the pharmaceutical and IT industries while also being a major producer of fruits and vegetables. It is a mineral-rich state. Two important rivers of India, the Godavari and Krishna, flow through the state; its agriculture sector is booming as well.

The prominence of food crop production and transport coupled with mining activities justifies the requirement for logistics services in the state.

I hope this analysis adequately demonstrates the need for logistics services in the mentioned states.

Sounds about right. Thank you for this comprehensive approach. Also, as we are going for series B funding, could you suggest to us the best valuation method and valuation of our company?

Valuation in the Series A funding round should be multiplied by the times the revenue has increased. Whereas the company is still in its initial phase the best valuation approach is the market multiple approach

Could you elaborate on why the market multiple approach is feasible?

The multiples approach seeks to capture many of a firm’s operating and financial characteristics in a single number that can be multiplied by a specific financial metric like EBITDA to yield an enterprise or equity value. It’d be the most credible approach as it relies on actual market transactions and involves minimal assumptions. Basically, indicating what the market is willing to pay for a company.

Could you elaborate on why the market multiple approach is feasible?

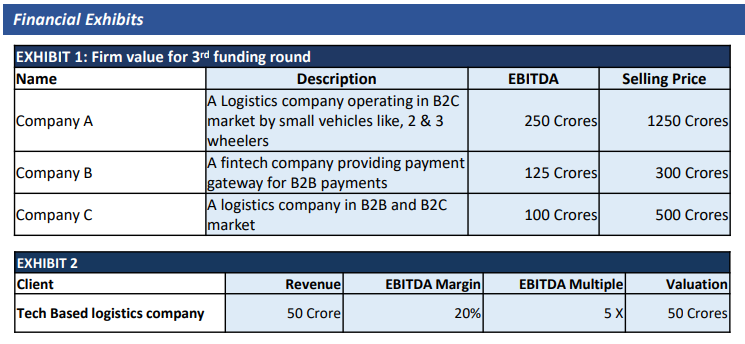

So for valuing the company I need some data regarding the recent acquisitions in the Logistics industry.

Ok, Go ahead with the valuation.

From the given information, company B is not a comparable company so it should be excluded from the analysis. Whereas, from the remaining 2 acquisitions we can identify that we can value the company by 5X EBITDA multiple. (Refer to financials)

Ok. Can you give me the exact number?

Since our client is making a revenue of 50 crores annually with EBITDA margin of 20%. Which gives us the EBITDA of 10 Crores. EBITDA multiple is 5X, so we raise round B funding at around 50 Crores.

Case Facts

- Tech-Based Logistics Startup

- On Series B Funding Round

- Current Operations: Kerala & Tamil Nadu

Approach

Case Recommendation

- Aim of reducing transit time.

- Providing a live tracking system.

- Efficiently progressing with the live pricing technique.

Brownie Points

- Analyzing more valuation methods.

- Interviewee should have suggested to go B2C as it will have a high growth probability.

Guesstimates

Financial Exhibits