VR FROM TEXAS!

Case Statement :

Your client is designing a social media as a response to the Metaverse. Calculate the serviceable and target market size of their product considering the whole social media audience.

Interview Transcript

Your client is a team of young coders, who are designing a social media as a response to the MetaVerse. The social media giant Famebook is moving towards creating a virtual reality, these coders aspire to promote more physical touch in this generation. Calculate the serviceable and target market size of their product considering the whole social media audience.

Famebook offers 100 million in the beginning of this year for acquiring a 90% controlling stake. Should the founders be comfortable in selling the company and if not, how much should they ask

for instead?

I would like to begin by asking some clarifying questions about the client.

Sure, go on.

What is the history of this team of coders and where is this company based out of?

The founders are experienced graduates in CS and Al. The company is currently operating in the US and they started off the venture out of Texas.

What is the capital composition like for the startup? Are any of the founders looking to exit?

The startup is completely bootstrapped and the 3 co-founders have equal stake till now and none of the founders is planning to exit from the company.

What is the vision of the product and services provided by the startup?

In times when virtual reality and technological takeover has made it so easy to communicate and interact, the company envisions to promote and propagate the importance of physical touch. Their motive is to popularize the concept of meeting people in person.

What is the target population for this product? And how does the product function?

The target population is the proportion of people above the age of 18 years having internet and internet compatible devices. The product is an application having two main verticals. The first vertical is a preference based chatting platform, through which people can connect with more

people having similar interests, liking and choices-in terms of movies, music, hobbies, art,

hours of chatting, the app locks the chat and unlocks when you meet one of the people you are chatting with and post a real time picture with them.

Sounds interesting, what is the second vertical of this application?

The other vertical targets the younger population, people around the age of 16+. Under this vertical the company launches new trendy games every two months which can be played by people across genders and ages.

Through this game, different leaderboards will be maintained, at the regional, national, global and community level. The points earned by a player is proportional to the number of people they meet. A certain number of points earned can be converted into cash to be redeemed via in app purchases or other purchases. To provide a holistic experience in the entire process, the company has its own experience centers where players can meet to experience the trending games and have playoffs in AR-VR mode. These experience centers will also act as the meet up hubs for the application users.

Now I’d like you to estimate the target market size of our client’s product.

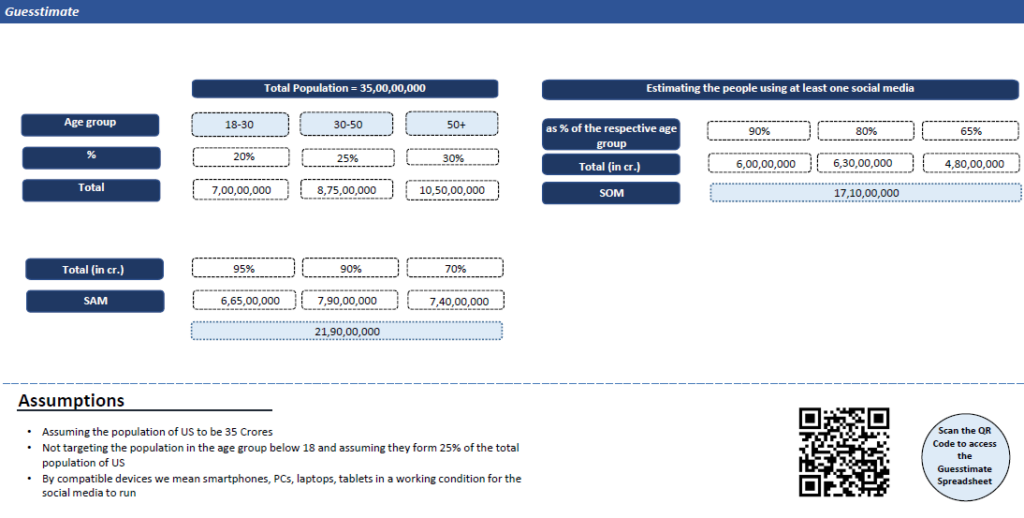

Taking into consideration that the product is launched in the US only, we’ll begin by dividing the population of the US on the basis of age. And since the population below 18 years of age is not our target market, dividing the remaining population among the age brackets of 18-30, 30-50 & 50+, gives us the total addressable market as 26 crores. Now we’ll divide the population among these respective age brackets on the basis of internet availability and compatible devices.

What do you mean by compatible devices?

By compatible devices we mean smartphones, PCs, laptops, tablets, etc. electronic devices which are in

a working condition for any social media app to run. Now assuming that the younger population has smart devices in better proportion as compared to the elder population, we get the Service Addressable Market as 21.9 Cr.

Is that the final target market?

Now, for the final target market, I’d like to further narrow down the service addressable market by taking people who use at least one social media, into consideration. Dividing the respective age

brackets further according to this, gives us the Service Obtainable/Target Market as 17.1 Cr.

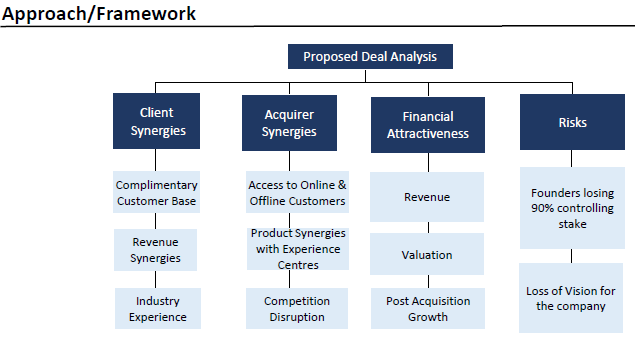

The target market estimation makes sense. Now how will you judge this deal?

professions etc – either through group chats or personal messaging. Further post a fixed number of Since the target market is sizable, the market attractiveness of the product is good. I’d like to judge the financial attractiveness of the deal and for that I will have to understand the objectives of the acquirer whether it is aligned with our client’s business objective or not. &

Sounds good, but we have no information on the objectives of the acquirer.

In that case, I’ll start analyzing the synergies that can exist between the acquirer and our client. From the acquirer’s point of view, it will get access to both the online as well as the offline market of

our client.

Offline famebook stores will be used to make the target population know more about Meta Verse, and in addition it will help in upselling the meta products at these places, which is the acquirer’s objective. From our client’s point of view, the geographies & the customers of our client & the acquirer are complimentary, which will act as a revenue synergy.

Alright, and are there any risks associated with this acquisition?

Yes, the major risk is that the acquirer will be getting a 90% controlling stake in our client’s company. This handcuffs our client from running the company as per their own vision. Also there will be an emotional risk associated with this acquisition.

Is there anything else that you’d like to analyze to judge this offer?

Lastly, I would like to weigh the deal on its financial attractiveness. This can be further broken down

into 2 aspects, the valuation we are currently getting for the deal, and the growth prospects going ahead.

Okay, to be able to analyze the financial attractiveness, please refer to exhibits 1 and 2 and tell me what you are able to judge from the same.

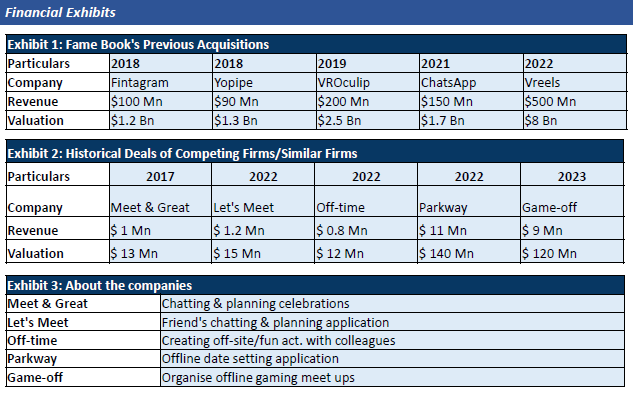

Exhibit 1 shows details of revenue and the valuation at which they were bought by Famebook, in the past 15 years. From quick math, I can judge that Fintagram was given a multiple of 12, Yopipe 14.4, VROculip 12.5, ChatsApp 11.3, and a whopping 16 to Vreels, its most recent acquisition.

Okay, what can you figure out from the second exhibit?

Second exhibit has the details of revenue and valuation at which competitor firms were acquired. Meet & Greet was given a valuation of 3 times its revenue, Let’s meet was given a valuation of 12.5 times its revenue, Off-time was given a valuation of 15 times its revenue, Parkway 12.7 Times and Game-off 13.3 times the revenue.

Okay, now, what would you conclude from this data set?

Referring to Exhibit 3, it is pretty clear that our business model is very close to what Game-Off’s was, hence our valuation multiple’s base should be nothing short of 13.3. On the upper side, given Famebook’s recent acquisition, Vreels, 16 seems to be justified too. Hence, I would like to conclude that the company should be valued anywhere between $133 Mn on lower side to $150 Mn on upper side. Historical data of acquisitions made by Famebook and the acquisition deals of similar firms, both point out to the fact that our company is being given an unjust valuation multiple.

Okay, can you give reasons for the same?

From the given information, I can only interpret that the scarcity of options, lack of prior experience

and being a Texas-incepted company, away from the hustle-bustle and start-up hot spots such as California, could be a reason why Famebook pegged an unfair multiple to the company. Given the

above mentioned synergies, this point of location bias becomes even more stronger.

Okay, can you delve deeper into the second factor while considering financial attractiveness? Yes sure, the second factor which I’d like to consider is the growth of the company post acquisition,

which I believe I have covered through the explanation of synergies earlier in the interview. The synergies are clearly outweighing the risks of the acquisition, and our company’s offline meeting points might as well serve as experience centers for Famebook’s VR gadgets

Okay, why do you think you should be concerned by the growth of the startup after its acquisition?

It is important to consider this aspect, as the founders are still retaining a minority stake of 10% in the company post-acquisition.

Recently a report stated that 50% of the tech-founders aren’t able to take their company to IPOs and take a backseat within 3 years of inception. Could you state reasons behind the same, and also why would they want to retain a minority stake in the company?

I believe the M&A activity in this field has increased manifold, and tech startups being boundary-less and innovative, are quick to grow. The point is proven quickly, owing to the seamless reach and the bigger players are keen to fuel the growth, or eliminate their competition through the mergers and acquisition of these companies.

This could be one reason why founders take a back seat and sell their company for a hefty valuation. The others could be more qualitative such as getting too passionate about the project, which might not

be economically viable, and hence giving up the power position under duress from investors.

There could be multiple reasons for the same, such as benefiting from the growth of the company, on the backing of acquisition by the largest social media player. While, the giant might want to retain the co-founders, as they seem to be the best fit to run the company, and a minor stake being the best manner to compensate them for the same.

Alright, this seems satisfactory, you may leave now, thank you!

Case Facts

- A team of coders based out of Texas has developed an application to popularise the culture of meeting people.

- Facebook Offers to acquire the startup at $100 Mn, for a 90% controlling stake.

- The product has two aspects –one targeting the older population around 30+ and the other targeting the GenZpopulation which involves engagement through games.

- The company has experience centers where people can meet and experience the games in AR –VR.

Case Recommendation

- Comparing the past acquisitions by Famebook, the multiple offered is significantly lower.

- The deal value should be between $130Mn to $150Mn

- The product synergies create great revenue and adaptability prospects for both the client and acquirer.

Brownie Points

- Estimating the range for the acquisition value using precedents.

- Analysing the potential future synergies with regard to product enhancement.

Guesstimates & Exhibits

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.