TURBOTHRUST

Case Statement :

Your client is a major Aviation MRO service provider with the highest market share in Japan. Due to limited geographic presence, the client has faced challenges in scaling their business beyond Japan. They are seeking your expertise to assess their strategic fit, and develop a comprehensive M&A strategy that aligns with the company's growth objectives and enhances its competitive position in the market

Interview Transcript

Your client is a major Aviation MRO service provider with the highest market share in Japan. Due to limited geographic presence, the client has faced challenges in scaling their business beyond Japan. They are seeking your expertise to assess their strategic fit, and develop a comprehensive M&A strategy that aligns with the company’s growth objectives and enhances its competitive position in

the market.

Before moving forward, I would like for some case facts to be validated.

- The Nature of Business for our client is Maintenance, Repair, and Overhaul services to Aircraft operators. The existing operation base for the client lies in Japan and they are looking to explain their operations overseas strictly through an M&A.

- The end customers for our client are Aircraft Operators including Airlines and Private Jets Operators including Individuals and Corporations.

- The client is a market leader in the existing geography. Do they have target geographies which are being considered for the expansion efforts?

The client’s scope of operations has been rightly pointed out. Their expansion thesis indicates an inclination towards an M&A, however, other means can be considered. The majority of the client’s customer base is Airlines with a marginal share of Private Jet Operators which can be overlooked for the purposes of this discussion. The company is a market leader in Japan in terms of Net Sales. They have identified India to be a suitable expansion target, however, insights to substantiate or refute the same can be considered.

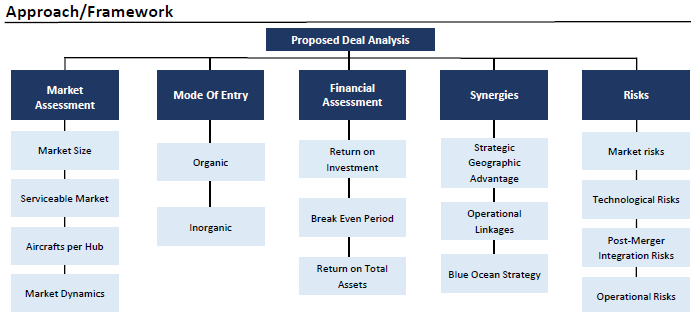

Alright. I would like to follow the following structure to come up with an M&A Strategy for the client.

- Market Feasibility of the Indian Market

- Assessing means of entry for the client

- Analyzing the Financial Considerations of the most suitable means

- Deciphering synergies for the client in the given market and with the given mode of entry

That seems to be a fair approach. You can start with the Market Feasibility and highlight the key areas you would like to assess.

Sure. I would like to assess the market across four fronts. First, I would like to understand the market size of the Indian MRO market. Second, I would demarcate the serviceable market that the client can cater to. Next, I would use the insights from the initial two metrics to quantify the customer base for the client in India. I would conclude this segment by discussing any remaining qualitative market

dynamics and trends.

This seems quite comprehensive, you can refer 1 to this Exhibit to perform your analysis.

Market Size: The current share of the Indian MRO Market is significantly disproportionate as it accounts for 0.25% of a $400 Billion Market which is a mere $1 Billion. However, the upside to the

given metric is that India’s re-positioning to the forefront of global economic influence and heavy

investments in infrastructure can possibly unlock the market’s potential in the Indian Geography.

Serviceable Market: The serviceable market in India is at par with the state of the fleet sizes of

Japanese Airlines. In addition to this, a 300% increase in the Indian fleet size can be witnessed in the

short run with 3x aircraft orders compared to the existing fleet.

Market Dynamics – The market is extremely fragmented with 8+ major players, and no specified market leader which leaves a lot of room for a well established MRO service provider to disrupt the

market. Aircrafts per Hub – India has two major MRO hubs – Delhi and Mumbai, compared to other geographies.

such as Germany and UK with similar fleet sizes, these countries have several hubs which would imply the initial CAPEX for setting operations would be relatively high compared to India. The Aircrafts per

hub for the Indian Market post delivery of the orders would be 1230.5 Aircrafts per hub. That is an insightful market analysis. You can move on to discuss the various means of entry for the client in the Indian Market.

Surely, given the underlying facts about the client’s operations, I would classify the different means of

entry into Organic and Inorganic with the following assessment.

Organic: Higher CAPEX require, Compliance fulfillment, No expertise of the Indian Market, Longer breakeven period

Inorganic: Lower CAPEX, since the Indian counterpart has pre-owned assets, No compliance, Shorter

breakeven, Support by the Indian counterpart with expertise in the Indian Market

Considering these parameters, an Inorganic entry through a Merger or an Acquisition would be the most suitable mode of entry for the client.

Alright. We have financial data to evaluate the most suitable mode of entry for the client.

The Financial data suggest the ROI of the Organic venture to be about 55% and that of the inorganic

venture to over 135%. The return on total assets for the organic venture is about 18% and 24% for the inorganic venture with the delta between total assets in the two scenarios being $1200 Million.

Considering all three parameters – Return on Investment, Break Even Period and Return on Total

Assets, Inorganic entry through a Merger seems to be the better option.

What according to you is the key metric that renders a merger to be a better route of entry and the rationale for it to be the final recommendation?

encompassing Human Capital, SOPs, Identifying key decision making areas for each of the two entities, Establishing a Governance structure and Change management plan.

The Organic venture has an exorbitantly high fixed cost (75%) compared to about 62% in an inorganic venture, which can be attributed to the following factors –

Great, we can close the case here.

- Barriers to entry for a foreign MRO service provider

Thank you

- Lack of pre-existing contracts, vendors, labour, facilities, etc.

Agreed. This is quite a comprehensive analysis, would you like to conclude the case by identifying any synergies?

Yes, I can foresee 3 synergies which the client can benefit from via an Inorganic venture. Strategic Geographic Advantage – Most Indian airlines have Japanese Hubs as their destinations, while most Japanese clients of our company have Indian hubs as their destinations. This provides an operational synergy wherein Japanese aircrafts can undergo Maintenance and Repair at Indian hubs and vice versa.

Operational Linkages – Due to pre-existing operations of the Indian entity, several fixed costs and variable costs are lower compared to an organic venture.

Blue Ocean Strategy – The MRO Market has never seen M&A activity of such scale, a strong foreign company joining hands with an Indian player implies cost leadership and advantage due to the Indian entity and Innovation and repute of the Japanese entity.

Can you also identify some risks associated with this deal and how can we mitigate them?

As for the risks, I would segment them into the following:

Market Risk: Barriers to entry for a foreign player, aggressive response to the entry by existing competition, price war, currency fluctuations.

Technological Risk: Sector wide disruption in technology, bridging technology and skill gap between Indian and Japanese entities.

Post-Merger Integration Risk: Managing cross border operations in varied markets, streamlining operations in different stages of business life cycle, people and culture challenges.

Operational Risk: Infrastructure gaps, supply chain and logistics

considerations, operational regulatory and compliance challenges.

As for the mitigation to the given risks, the former two pose a significant threat to the client, however, they hold very slight scope of occurring – post our analysis of the market. While, the latter two can be addressed through effective post-merger integration efforts

Case Facts

- The client is an Aviation MRO Service provider based in Japan. The company being the market leader in Japan wants to expand to other geographies.

- The key customer base for the client is Airlines.

- India has been considered as a suitable expansion target. With an expected fleet size growth of 300% in the short run

Case Recommendation

- An Inorganic Market Expansion arising due to the delta in the fixed costs between Organic and Inorganic ventures.

- Impactful operational and market entry synergies such as cost leadership, lower CAPEX, etc. can be established with a merger in the Indian MRO space.

Brownie Points

- Post merger operational synergies

- Fleet mapping with other countries

Exhibits

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.