CHOCOLATY AFFAIR

Case Statement :

Your client a PE firm is looking to acquire Willies Chocolate and aim to achieve 10% EBITDA Expansion within one year to justify the acquisition. They have come to you to understand the way forward for achieving the growth target.

Interview Transcript

Your client is a PE firm specializing in lower middle market companies in buyouts, recapitalizations,corporate carve-outs, restructurings, and bankruptcies. They are looking to acquire Willies Chocolate and aim to achieve 10% EBITDA Expansion within one year to justify the acquisition.They have come to you to understand the way forward for achieving the growth target.

I would like to understand the client better before I proceed to devise a strategy. What are the products Willies Chocolate offers and the sales channel they operate through?

Willies Chocolates, founded in 1950, is a legacy chocolate brand with a national presence. They have two products that are milk chocolate bars and gummy bears.They are present across all the channels including e-commerce, q-commerce, modern trade, and traditional trade.

Okay, so may I know the revenue of Willies chocolate, and what is the split between Milk chocolate bars and gummy bears? Along with that, what are the YoY growth of Milk chocolate bars and gummy bears?

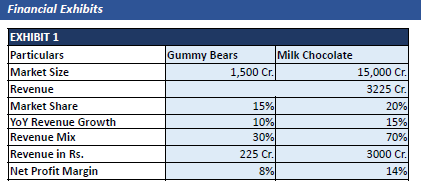

The market size for Gummy Bears in India is Rs.1,500 Crores, for Milk chocolate, the same is Rs. 15,000 Crores. While we have 15% market share of Gummy Bears, we have a 20% market share for Milk Chocolate. The EBITDA margins of Gummy Bears are 8%, while for the milk chocolate, they are 14% from the MRP.

Okay, now how are our two products performing on a year-on-year basis?

The revenue from Gummy Bears grows at a rate of 10% YoY, while the revenue growth rate of milk chocolates is 15% p.a

Okay, based on the data, the revenue of the firm is around Rs. 3,225 Crore, Rs. 225 Crores coming from the 15% market share we have, and the Rs.3000 Crores being attributable to the 20% market of Milk chocolate captured by us. On the back of a lower growth potential due to a small market size, and 8% EBITDA Margins, the product will not be able to contribute to our mission of 10% EBITDA expansion, and must be replaced with another product, which has a larger market size, is in line with the changing public preferences, and has better margins.

Now that you have advocated the closure of one product line, you must tell which one to replace it with. The client has three products in mind- protein bars, fruit-flavored candies, and Dark Chocolates. Which Option would you move forward with and why? Just to be clear we are indifferent to all the options and just need the reasons on which the decision can be made.

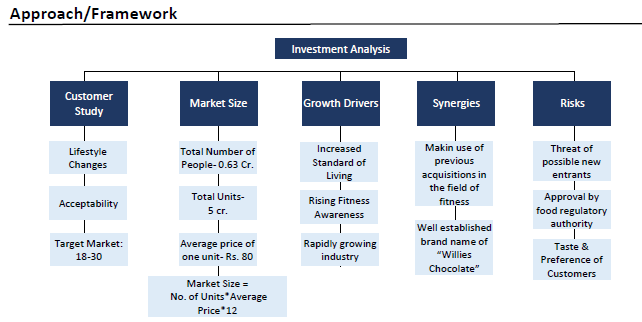

I will consider these options on two parameters; one is the EBITDA margin and the other is the Growth prospects in the market

Okay, so the EBITDA Margin is 20% for all these products, I would like you to focus on other factors.

I believe with the upsurge in fitness trends and growing demand for protein-rich substitutes suitable for all age groups, protein bars are the alternative I would move forward with as they have a wider appeal, and a greater market to cater to. Also the client’s established brand name “Willies Chocolate”, is likely to synergize with the marketing of Protein bars and customer loyalty can be an added

advantage.

Okay Great! Since you are moving forward with protein bars, I would like you to calculate the market size for the same. (a similar guesstimate can be solved for the other 2 alternatives, however the filters might differ a bit owing to the nature of these products.

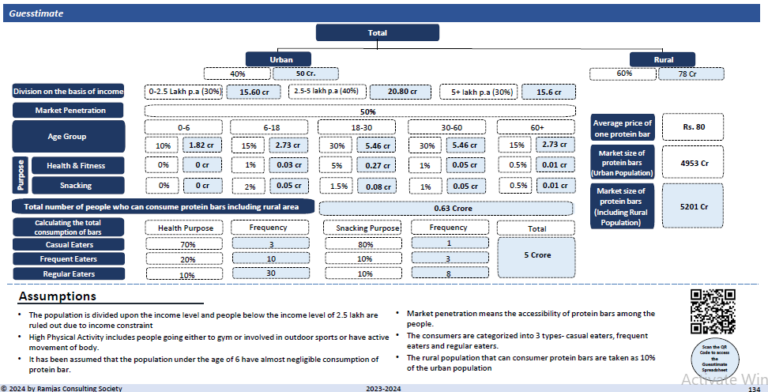

I would proceed with assuming that the market of protein bars is dependent highly upon age group and purpose of consumption which can be classified as health and fitness, and snacks. Also, it depends upon the income level of an individual because of the high price of protein bars.

Sure.

Now, since protein bars are nutrient-rich and healthy, they can be consumed by people of all age groups, and hence I will divide the entire population into 5 age brackets 0-6, 6-18, 18-30, 30-60, and 60+ however, the consumption will be negligible under the bracket of 0-6. I will further divide the population based on- Health and Fitness, and Snacking where health and fitness include people who are involved in high physical activity or use protein bars for meal replacement and weight gain.

Yeah, that’s fair enough.

As per my calculations and assumptions, the consumer base for protein bars is 62 lakh individuals in urban areas and the number is 6 lakh in rural areas. Despite a greater proportion of people living in rural India, a relatively smaller number is likely to consume protein bars owing to low market awareness, constraints regarding income, and rigidity in tastes and preferences.

That’s a reasonable number, what will be the next step?

Now looking at the eating habit of people, I would categorize them in 3 categories- casual, frequent and regular eaters. Considering the frequency of people varying with their preferences, income level, and purpose of consumption, there are 2 crore bars consumed by casual eaters, 1 crore bars by

frequent eaters, and 2 crore bars by regular eaters in a month. By taking an average price of Rs. 80 for one bar, we come up with a market size of approximately 5,601 Cr annually.

As per your calculations, the market size of Protein bars is 5,601 Crores. For now let us peg it at Rs.5000 Crores. Given the EBITDA Margins, and the company’s goals, kindly tell me what percentage of the market shall the company capture, to be able to achieve the target.

As per my calculations, the company’s EBITDA lies at Rs. 438 Crores, which is 13.5% EBITDA margin. If the company wishes to expand EBITDA by 10% in one year, it wishes to achieve an EBITDA of approximately 15%.

As the revenue from Milk Chocolates grows by 15% P.A, it will increase to Rs. 3,450 Crores, and the EBITDA from it will amount to Rs.483 Crores.

To achieve an overall 15% EBITDA, the minimum EBITDA to be earned from the Protein Bar Market is Rs. 96.6 Crores.

As mentioned, the EBITDA margins for protein bars is 20%, the revenue from this product should be Rs. 483 Crores.

Given that the market size is Rs. 5000 Crores, we must capture roughly 10% of the market within one year.

Great! Now can you tell me if this target is achievable and if yes, then what are your recommendations to achieve them

I would recommend the firm to ramp up the sales network and its reach. As we are supposed to control our costs, I can only suggest that instead of ramping up marketing cost, one should focus on the product quality and hence, the target will be achievable.

Great, It was nice interacting with you. All the Best!

Case Facts

- Willies Chocolate’s best selling products are -Milk Chocolates & Gummy Bears

Case Recommendation

- Shutting down the productionof Gummy bears and launch Protein Bars as an alternate product

- Ramp up the sales network and its reach.

- Focus on the product quality instead of Marketing to achieve the 10% EBITDA expansion.

- Because for EBITDAexpansion, go ahead with marketing activities which are cost efficient

Brownie Points

- To be able to solve the case, analyze the financials carefully.

- Give reasons qualitative along with quantitative reasons for choosing the product which is being shut down.

- Give good reasons for choosing the product.

Guesstimates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.