REAL INTEREST

Case Statement :

Your client is a PE firm looking to acquire an artificial jewelry-making company looking to expand online retail. They come to you to understand the way forward for this objective

Interview Transcript

Your client is a PE firm looking to acquire an artificial jewelry-making company looking to expand online retail. They come to you to understand the way forward for this objective.

Alright, I would like to understand the client better before I proceed with my approach to devise a strategy.

Our client is Alpha Capital, a PE firm established 50 years ago. Since its inception, the firm has invested in varied industries ranging from EV, e-commerce, q-commerce and lifestyle and apparel brands.

What are the goals that the fund is aiming to achieve through this investment?

The firm is looking forward to maximizing profits and at the same time diversifying its investments to balance the risk proportions. Ideally, the investment option should have a high growth potential and some existing synergies with its existing business.

Fair enough. I would now deep dive into the potential investment. Could you tell me something about the artificial jewelry business?

They have been operating in Delhi and NCR regions of Noida and Gurugram for about 15 years They have about 20 stores currently. They sell all types of jewelry sets, necklaces, earrings, bracelets, etc. They specialize in modern Indian wear items.

I would like to begin by analyzing the attractiveness of this jewelry segment first. I will start by segmenting the industry. The jewelry industry in India has two major segments – precious metals and stone jewelry and artificial jewelry. Further, both categories have big-scale local players, small- scale local players, and branded players.

Ok great, further I would like you to estimate the revenue of the artificial jewelry firm from their current operations.

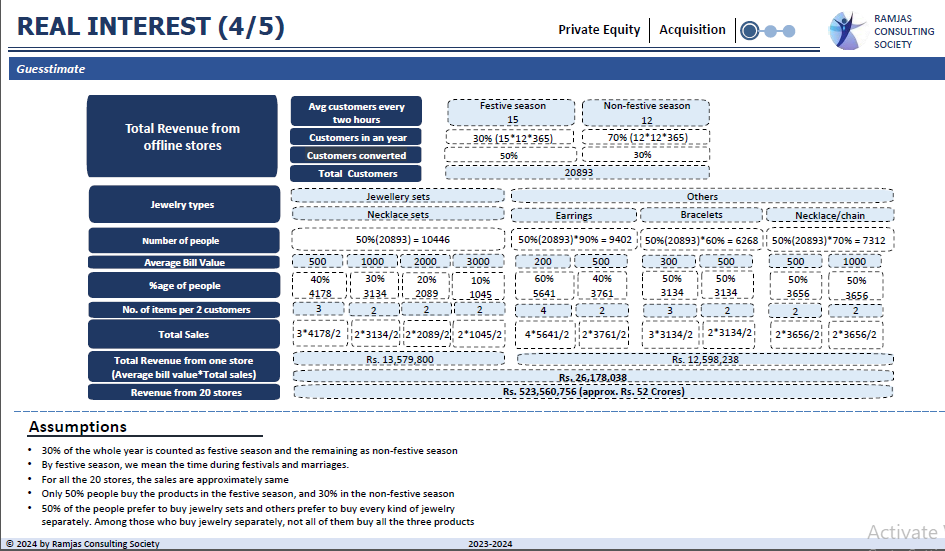

Okay, so I would proceed with assuming that the major difference in sales is considered by the two different phases in the year the 30% of the complete year is the festive season and the remaining is the non-festive season. Since the jewelry firm is well-established in NCR, would it be fair to suppose that one store is visited by 15 customers and 6 customers every hour in the festive and the non-festive season respectively?

Yeah, that’s fair enough.

Great, so the store will be visited by 21000 customers approximately, in a year. Now, if we look at the products offered by the firm. Should I consider all the items sold individually or consider them in sets? I am assuming that they sell two types of jewelry items-jewelry sets and items like earrings, bracelets, and necklaces, may I?

You can consider them in sets one being jewelry sets and the other being items sold individually as earrings, bracelets and necklaces.

Alright. Considering their average bill values and the number of items purchased by a customer at a particular visit, we can come up with the revenue for one store, which comes to approximately Rs 28,900,000. Since all the stores are located in the same area, it would be reasonable to assume that all the stores are visited by more or less the same number of customers. Hence, the total offline revenue of the firm comes out to be Rs. 579,000,000.

Alright, now this firm is planning to expand its operations in the online space and downsize the offline operations. What are the possible ways in which this can be done, and which method would you suggest?

The company can choose to launch its own website or can collaborate with a fashion e-commerce platform. To get better traction and improve sales, collaboration would be better suited. The cost of listing the brand will comparatively be lower than the cost of setting up its own website alongside delivery logistics costs. With e-commerce, operations will no longer be limited to the Delhi and NCR region, thus multiplying the revenue.

Fair enough, I would like for you to estimate the revenue obtained from the online expansion as well.

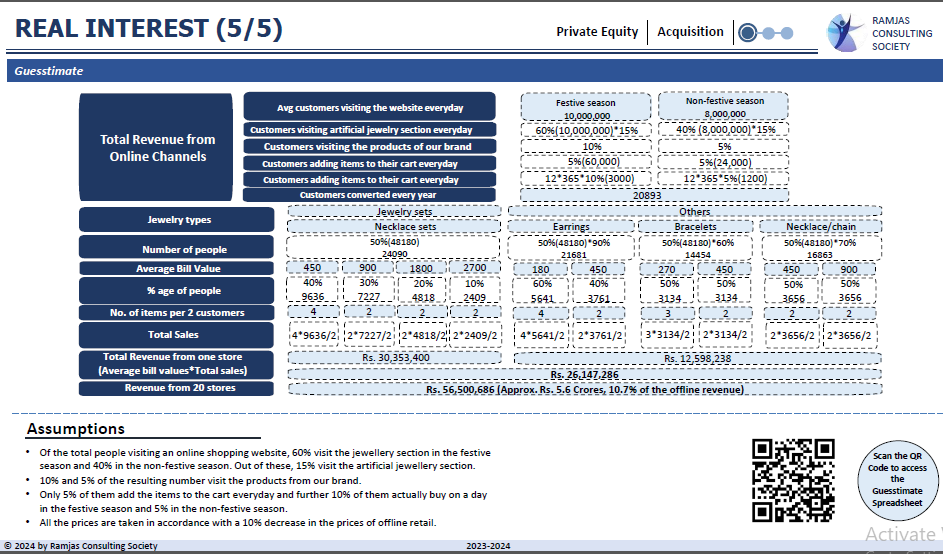

Okay, I am assuming we are collaborating with a well-established fashion e-commerce platform, let us say that it is visited by 10,000,000 users in the festive season and 8,000,000 users in the non- festive season, out of which 40% visit the jewelry section and 15% of these visit the artificial jewelry section further, Considering the competition in this market, shall I assume that initially, only 10% of these users will be looking at the products from our brand in the festive season and 5% in the non-

festive season?

Yes, these proportions are good to go.

Cool, so considering that 5% of these users will like our products and add them to their carts, and finally 10% of these will buy the item, the number of customers converted in a year becomes 48000, approximately. Now, to estimate the revenue I would like to assume that there will be a 10% decrease in the prices in online retail with respect to offline retail.

Again, considering the average bill values and the number of items purchased by a customer at a particular visit to the website, we can come up with revenue which approximately is Rs 65000000.

Great! Now I would like you to evaluate the investment into this business.

I would begin by taking into consideration the key metrics of this industry. The metrics taken into consideration would be the growth rate of the industry and the industry margins.

Considering the niche of the industry and the fact that precious metal jewellery is still the preferred choice of the masses, the CAGR would be nearly 7-8%. Moreover, Considering the low cost of production, the profit margins vary from 30-50% depending upon the type of piece like a necklace, set, earrings, etc. Further, the company is planning to downsize some of its operations and expand into the online space. Considering these factors, there will be cost-cutting-in terms of the workforce employed, reduction in store maintenance costs, etc.

Adding 10-15% to the profit margin. While collaborating with an e-commerce platform, the marketing budget would be more weighted towards social media and digital marketing – implying a ROAS of roughly 150%, Considering the additional revenue of 25-30% that can be generated from the expansion plan, the acquisition of the artificial jewellery chain is the viable option and would justify the deal’s value.

Alright, what according to you would be the risks involved in the acquisition of this business, and suggest methods to mitigate them?

The risks involved are mainly business risks and are as follows:

- Considering the expansion into the online space, the bargaining power of the consumers is much more, thus the prices of the products and the discounts offered need to be made competitive to ensure the required sales from the online segment.

- Considering that the e-commerce space is very commonly used by the Gen-Z population, Indian wear jewelry might seem irrelevant to them. Thus, the product line needs to be diversified and made to include western wear jewelry to cater to a wider segment of society.

- Thirdly, durable and costly packaging might be required to ensure that no damage is done to the items in the shipment process and that customers are satisfied

So, these are the jitters that our business will have to face in the short term, but what problems can our company encounter in the long term?

Our business can face the issue of being cyclical. In the future, our business can be pegged to the Indian wedding season, if the consumer base gets very concentrated. We can shift our focus to

customizing and personalizing imitation jewelry.

We should try to leverage rising fashion consciousness among teenagers to mitigate this risk. Along with this, we can also focus on the men’s jewelry market which has huge upside potential going forward.

What could be the other possible solutions to this issue?

- We could use the Monthly Unique Transacting customers to analyze the monthly variance in revenue for the e-commerce store. It would help in defining trends pertaining to the cyclical nature of our business.

- We could reduce the overall expenditure on marketing, starting with funnels that have the highest CAC (Custom acquisition cost) and least conversion rates.

In addition to these, to maintain the AOV(Average order value) for the long term, we can start with a scheme of special credit points pertaining to our platform only. Buyers would get 10 points on ₹1000 shopping. This scheme will provide heavy discounts to customers that will facilitate increasing repeat orders. This will help in clearing dead stock, in turn solving the problem of high inventory. These products can be tweaked according to the present trends and designs to ensure product relevancy.

Considering all the facts related to the company in question, do you think this investment is viable for the client?

The investment seems a viable option considering the objectives of the firm. The firm can leverage its connections in the e-commerce and q-commerce fields and contribute to the success of the online expansion. The risk and growth potential are promising enough and in line as per the client’s objectives.

Case Facts

- PE firm -established for 50 years

- Heavily invested in e-commerce, q-commerce and lifestyle and apparel business.

- Investment plan: In an artificial jewelry firm.

- Objectives of the firm: Diversification of investment portfolio, risk complexion and profit maximization

Case Recommendation

- The acquisition of the artificial jewelry chain is the viable option and would justify the deal’s value.

- Diversification in the product port-folio

- Customization of imitation jewelry

Brownie Points

- Competitive prices and products can be offered

- Personalizationof imitation jewelry

- Increasing fashion awareness amongst teenagers

- Inclusion of men’s jewelry which has a high growth potential

Guesstimates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.