FundVenture

Case Statement :

Your client is a bulge bracket investment bank looking to set up a mutual fund in India. You have

been hired to analyze the viability and route of entry for the client.

Interview Transcript

Your client is a bulge bracket investment bank looking to set up a mutual fund in India. You have

been hired to analyze the viability and route of entry for the client.

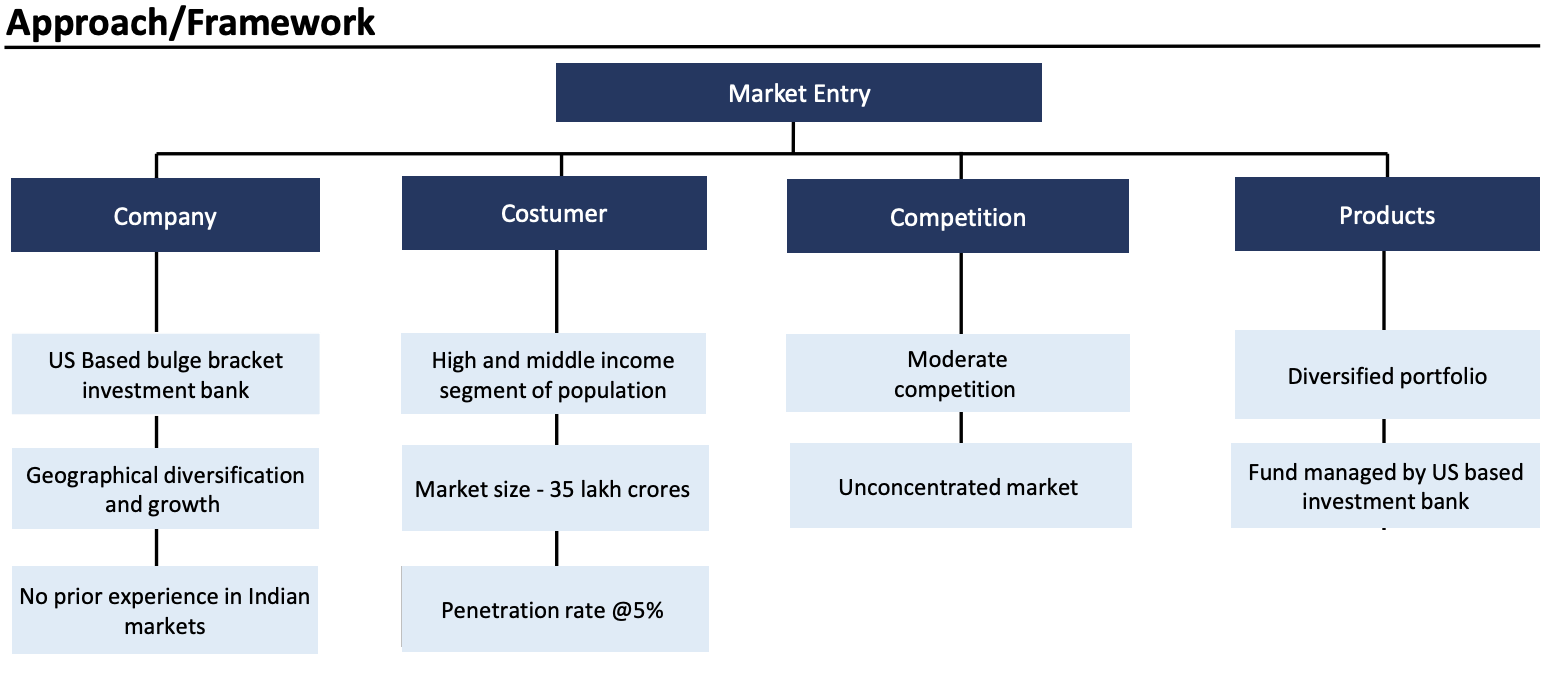

To reiterate, our client is a bulge bracket investment bank that wants to enter the Indian market by setting up a mutual fund and we are required to analyze whether it is viable or not, and if viable, suggest entry routes.

That’s correct. You can proceed.

Before starting the case, I would like to know more about the client. Where does the client currently operate? Do they have any prior experience in the Indian market? What are the client’s objectives behind setting up a mutual fund in India?

Our client is a US-based investment bank operating in multiple markets and this will be their first experience in the Indian market. The reasons behind setting up a mutual fund in India include various favorable factors such as positive macroeconomic trends, a growing middle-income population and the need for global diversification.

Which group of the Indian population does the client aim to target and what is the existing level of competition in the market?

The client does not aim to target any specific segment of the population. Moreover, the Indian mutual funds market is moderately competitive.

Also, is the mutual fund targeted towards any securities?

No, the client will not be targeting any specific securities, it will be a diverse portfolio holding. You can start with assessing the viability of entering the market.

To assess the viability, I would like to calculate the market size of the Indian Mutual Funds Market.

Okay, you can continue.

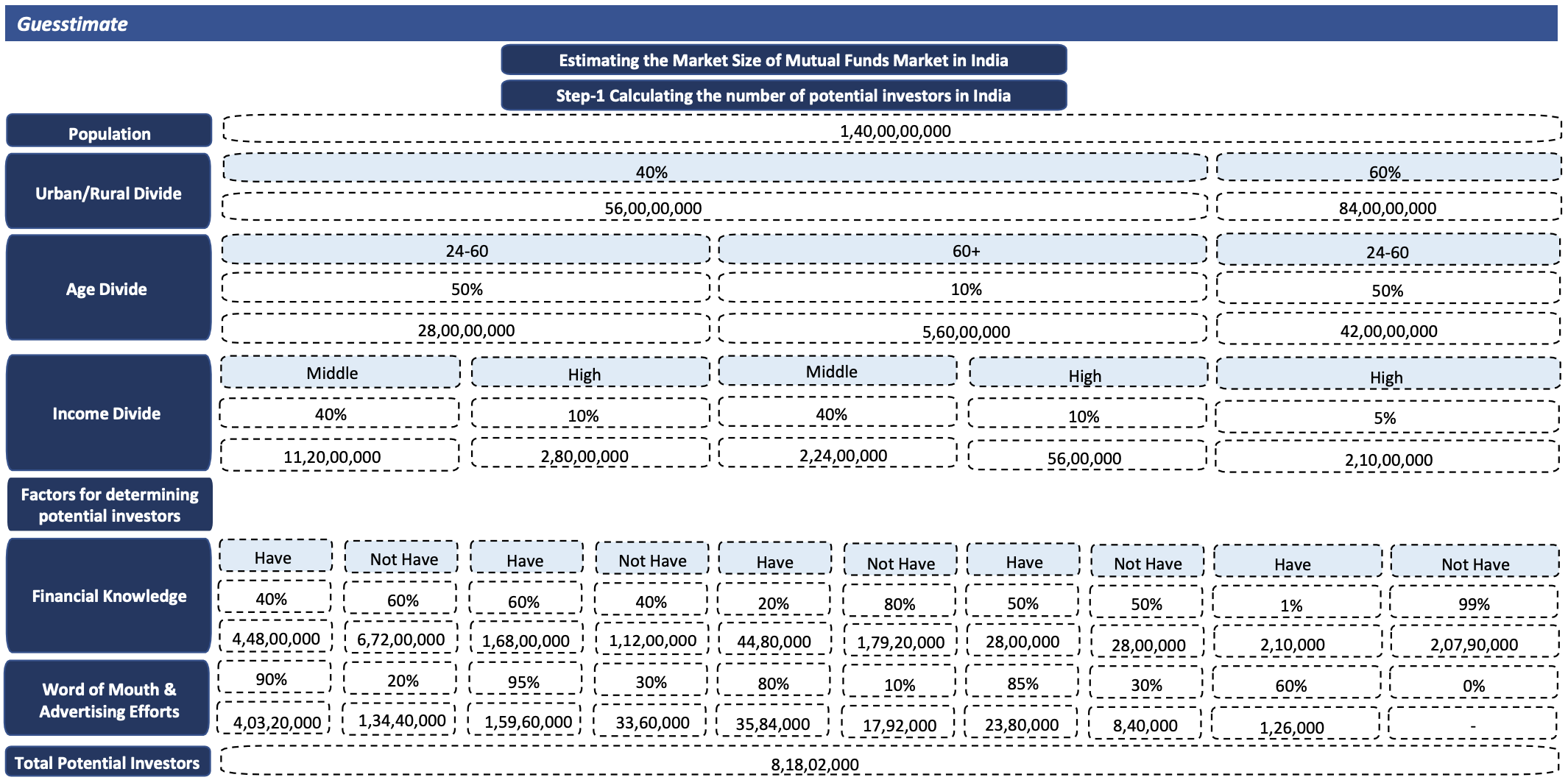

First, I would calculate the number of potential investors of mutual funds in India by focusing on the age bracket of 24-60+ years and above in urban areas, which is usually the age bracket that invests and only 24-60 years in rural areas, excluding the 60+ age bracket since they are risk-averse and more inclined towards fixed income options with less market interactions. Further, I would classify the population on the basis of income-divide. In urban population, the middle and high income category would be considered assuming percentages of 40% and 10% respectively, whereas in the case of the rural population, I would consider the high income category with a percentage of 5%. The population would then be further filtered by being divided into those who have financial knowledge and those who don’t. This is based on the assumption that, as a result of marketing campaigns and word-of-mouth, a sizable portion of the former group will become potential investors, and a smaller portion of the latter group will also become potential investors. Taking rational percentages for the same, we boil down to a number of approximately 8 Crore potential mutual fund investors. Shall I continue and calculate the amount invested in mutual funds?

Yes, you may proceed.

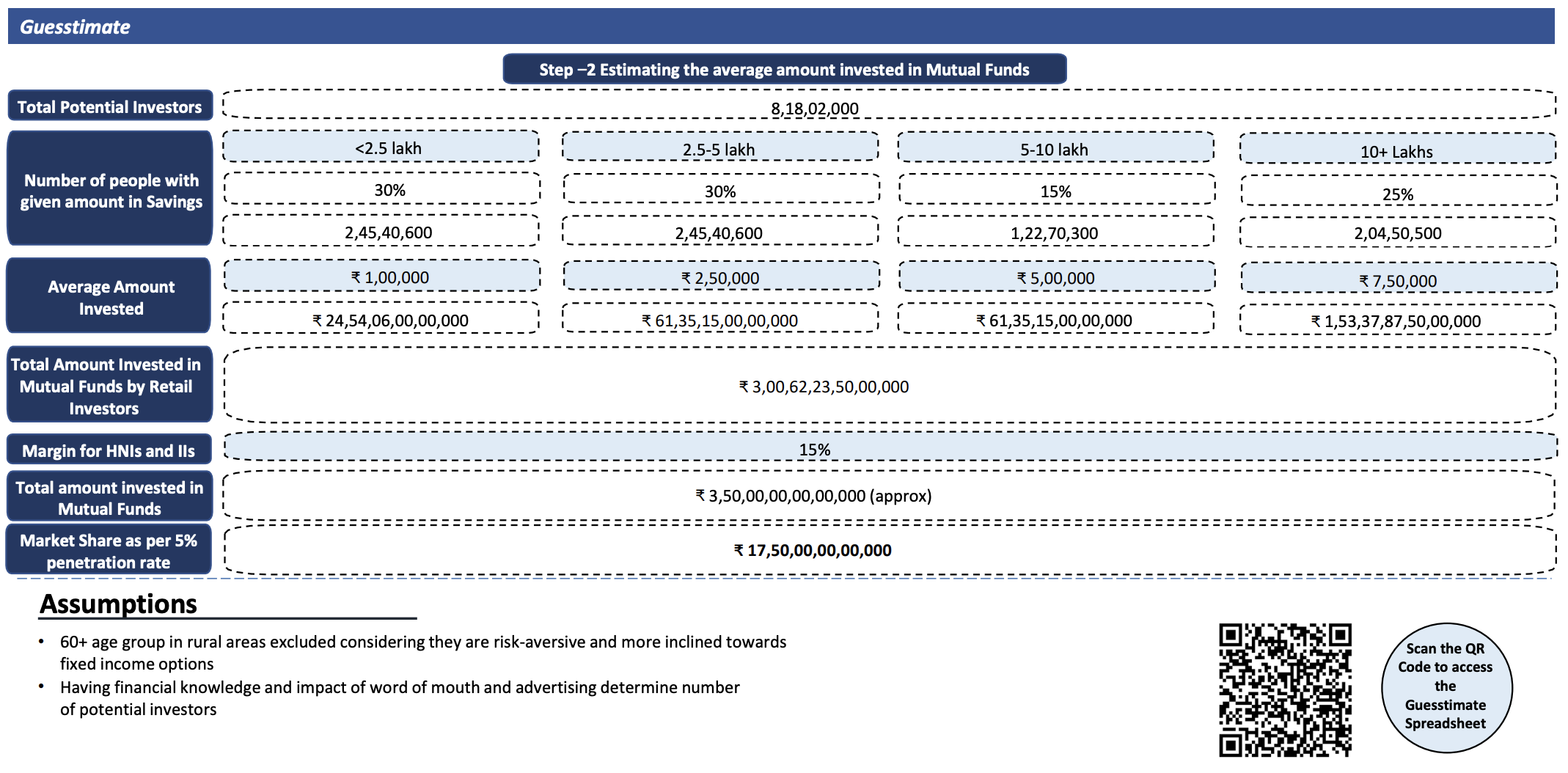

In continuation, to calculate the amount invested in mutual funds, an estimation can be made of the average amount invested by people. For this, I assume that 30% of the potential investors have less than 2.5 lakh in their savings, another 30% have 2.5-5 lakh, 15% of them have 5-10 lakh and that the remaining 25% have more than 10 lakh. Furthermore, on an average, I assume that based on the amount in their savings account, they invest 1 lakh, 2.5 lakh, 5 lakh, and 7.5 lakh in mutual funds respectively. Thus, as per my calculations, an amount of 30 lakh crore is invested in mutual funds by retail investors. Adding 15% for HNIs and Institutional Investors, we can conclude that approximately 35 lakh crore is invested in mutual funds.

Sounds good. What would you consider next?

Coming back to the competitors, what can be our potential penetration rate?

Taking the current competition into consideration, if we enter the market we will be able to penetrate 5% of the market.

So, at a rate of 5%, we would be able to penetrate the market equivalent to 1.75 lakh crores.

Great, the target market seems promising! Now that it is concluded that it is viable to enter the market, what probable entry routes do you suggest that the client can opt for?

The probable entry routes that the client can opt, can either be setting up an own Asset Management Company, acquiring an existing mutual fund, opting for a joint venture with a well-known bank, or opening a subsidiary.

Keeping those in mind, what are the possible barriers to entry that the client could face?

Considering industry wise barriers, the Indian mutual fund market is strictly regulated. Moreover, being a foreign bank, there are a lot of compliances from various authorities like SEBI, RBI, AMFI & MCA that needs to be fulfilled. Being a legal process, it can be very time-consuming and hectic. Additionally, opening a subsidiary or acquisition will require more compliance issues and hefty funds requirements.

We are not willing to invest a huge amount so, suggest whether the client should enter the market by setting up an own Asset Management Company or they should enter in a joint venture with a well-established Bank.

To analyze both the options, I would consider:

Cost of setting up: Setting up a mutual fund has a cost relating to registering the firm with different authority, tie ups with banks, tie ups with underwriters and issue houses. Apart from it, setting on own will also cost a higher advertising cost. However, if we enter through a joint venture, we will be sharing this cost.

Regulatory issues: There can be a lot of regulatory issues of setting up an own AMC which can be reduced by opting for a joint venture.

Goodwill: Entering a joint venture with an established bank will provide us a face, common and trusted amongst the general public and also a face for the fund towards regulatory bodies.

Based on this analysis, it can be concluded that the option of joint venture does have more pros but the client should keep in mind the drawbacks of entering through a joint venture like profit sharing and ownership dilution. However, I believe in this case, the pros of opting for a joint venture outweigh its cons.

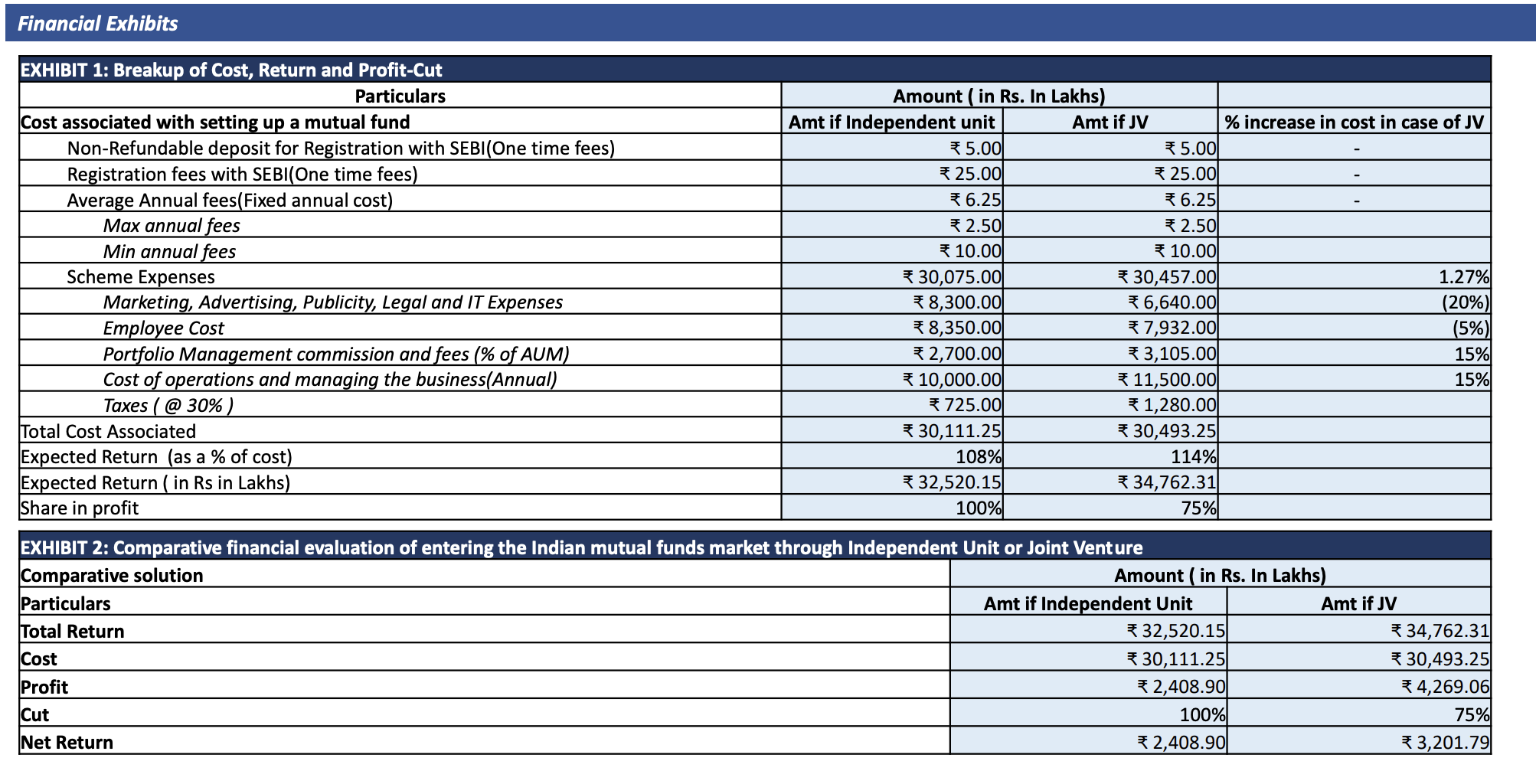

Yes, that is a reasonable conclusion. Let’s analyze these options quantitatively as well. I will be providing you with a few facts and figures and you will have to analyze which option is more profitable for the client. In order to establish a mutual fund in the Indian market we will have to register with SEBI which requires 30 lakhs as one-time fees. Additionally, there is a minimum annual fee with SEBI which is 2.5 lakhs which can go up to 10 lakhs. Additionally, there will be scheme running expenses which can be bifurcated as: Marketing cost at 83 crores, Employee costs at 83.5 crores, portfolio managers fees and commission at 27 crores and other operational costs will stand at 100 cr. Calculate the total cost for me to establish our own asset management company.

So our one-time fee is 30 lakhs, and on an average, we will be required to pay a sum of 6.25 lakhs to SEBI as fixed annual fees. Additionally considering 293.5 crores of scheme expense the total cost required will be 293.8625 crores before tax.

Great, Now we are expecting to get a return of 8% on total cost including taxes. Calculate the revenue and profit we will be generating keeping in mind 30% taxes.

Since our total cost is 293.8625 crores, an additional tax @ 30% will be charged on profit, that can be computed by deducting cost from revenues. So our tax will be 7.25 crores and our total cost (including tax) will be 301.1125 crores. And our profit will be 0.8*301.1125 which will be approximately 24 crores.

Great, so now let’s assume we will be entering in a joint venture with 75% of profit share since the venture bank will lend its name for regulatory compliance and goodwill and the operations would primarily be carried out by the foreign bank. Can you compute our return in this scenario?

Sure, I would start by assessing the changes in our variable cost drivers. Would there be any impact on our marketing and employee benefit expenses due to the enhanced goodwill of the existing bank and its knowledge of the country’s regulatory compliances?

Yes, the marketing cost will be saved by 20% and employee cost by 5%. Additionally, entering into a joint venture will bring in additional 15% Assets Under Management. Will it impact any of our other costs?

Yes, Since the portfolio management fees and operations cost are charged as a percentage of Assets under management, any change in Assets under management will lead to a proportionate increase in these costs. Both of the costs will increase by 15%.

Great, both of these costs will be rising by 15%. Now, you are required to compute the revenue for the joint venture. Assess and evaluate both the situations keeping the taxes @30%.

Since we were having a return of 325.2 crores, and now due to additional goodwill of the venture, our total assets under management will rise by 15%, bringing the cost of the venture at 304.93 crores which can be bifurcated as marketing cost at 66.4 crores as we are saving 20% due to goodwill of joint venture, employee cost at 79.32 crores due to a decrease of 5%, operational cost 115 crores and portfolio management fees at 31.05 crores, with an increase of 15% due to proportionate increase of 15% in assets under management. Our net return will be 32.01 crores after deducting taxes at 30%, that is 12.8 crores and considering our 75% cut. Comparing both the results, the net profit of a joint venture is approximately 33.33% higher than that of entering organically, again concluding that joint venture would be a better option.

Yes, that would be correct. Would you like to give any recommendations regarding the same?

As concluded before, in the given scenario, the client should enter through a joint venture. As a recommendation, they should choose a well-established bank with strong goodwill as their co-venture. However, the client should keep in mind all the statutory requirements. Moreover, they should focus on marketing strategies & enhancing the investor experience to successfully penetrate the competitive market. Some ways to advertise can be digital marketing through emails and social media, uploading timely content on websites & newspapers having financial advisors and investors as their audience.

Thank you, we can end the interview here.

Case Facts

- Company Overview: A US-based Bulge Bracket Investment Bank operating in multiple markets with no prior experience in the Indian market.

- Objective: Geographical diversification and growth.

- Market Overview: 5% Market penetration rate in case of setting up own asset management company and an additional 15% over it in case of joint venture.

- Manages diversified portfolio holding.

Approach

Case Recommendation

- The client should enter the market through a joint venture with a well-established bank.

- They should focus on marketing efforts and enhancing investor experience.

- Some ways to advertise can be digital marketing through emails and social media, uploading timely content on websites & newspapers who have financial advisors and investors as their audience.

Brownie Points

- In the guesstimate, an additional 15% can be taken into account for the amount invested by institutional investors in the mutual fund market.

- Providing recommendations to increase the potential customer base and channelizing the household savings into mutual funds.

Guesstimates

Financial Exhibits