Best out of waste

Case Statement :

Your client is a PE Firm that is looking forward to investing in a Waste Management Company in Delhi. The company is looking forward to developing capabilities to transform the waste collected into energy.

Interview Transcript

Your client is a PE Firm that is looking forward to investing in a Waste Management Company in Delhi. The company is looking forward to developing capabilities to transform the waste collected into energy.

I would like to begin by asking some preliminary questions

Sure. Go ahead.

What are the objectives behind this investment of the PE firm? What is the time frame for exit and what is the expected return? Is the firm looking to contribute financially, technologically, or an amalgamation of both of them?

Yes, so the firm is a thematic investing Private Equity, focused towards green investing. A time frame for exit is around 10 years and they are looking forward to making a financial contribution.

Where and what services is the waste management company providing?

The company is into the collection of municipal waste and is based out of & operating in Delhi.

Ok, may I know something about the financial performance of the company? How is its revenue growth and what share of the market has it captured?

The company has a sizable portion of the market and is the largest player amongst the 3 in this industry in Delhi. I would now like for you to tell me the estimated revenue.

Yes sure, so they must be collecting 3 types of waste from Households, Street Vendors, and Commercial Establishments.

Alright, go ahead

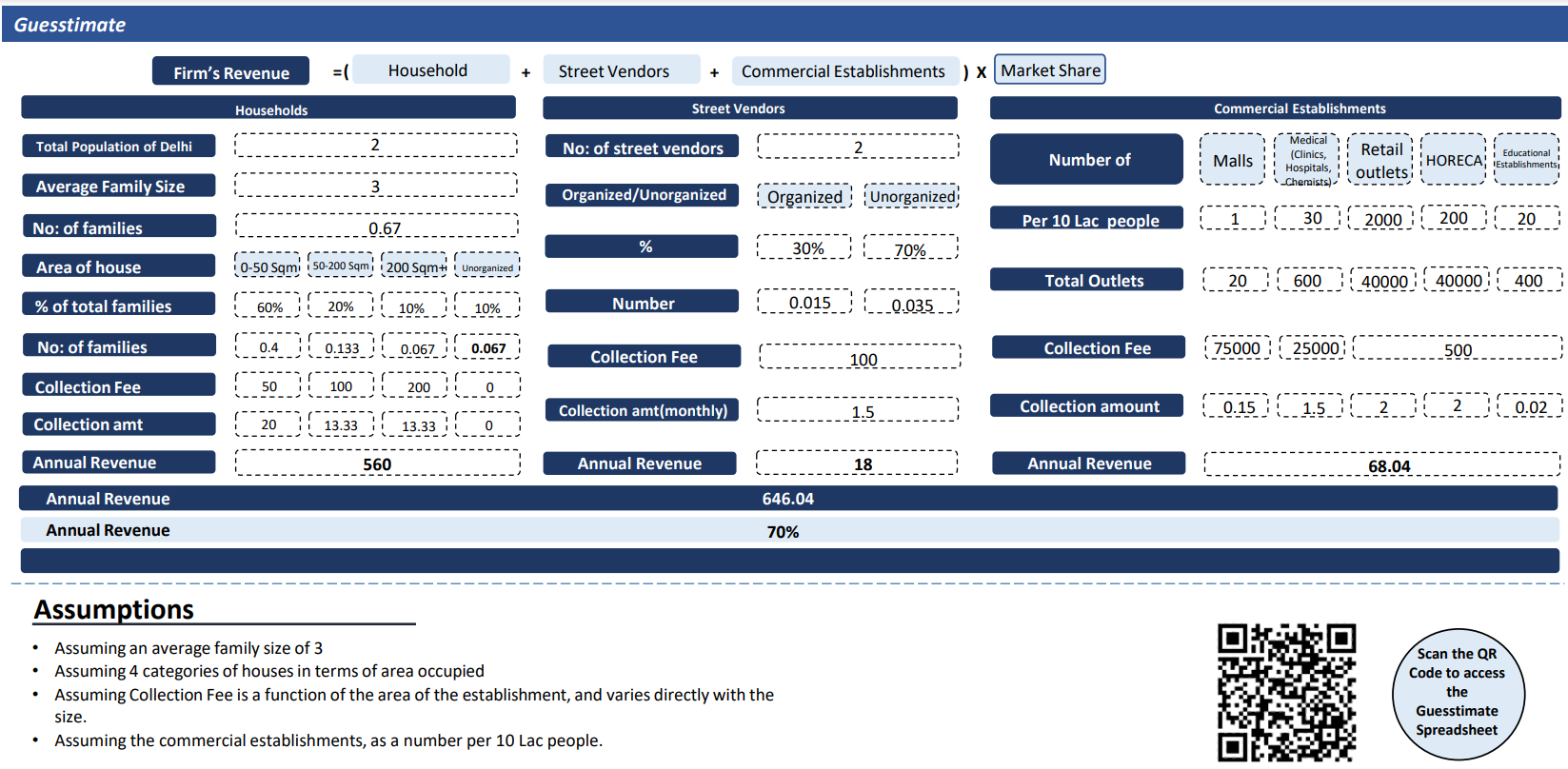

First, I am going to calculate the number of households, the population of Delhi is about 2 crores, and the average family size is 3, so we get 66 Lakh families. As the collection fee depends upon the size of the house in Delhi, it can be divided into 4 types, 0-50 Sqm, 50-200 Sqm, 200 Sqm+, and an Unorganized/others category. I assume that 60% of the families live in the first category of houses, followed by 20% in the 50-200 sqm category, 10% in the 200 sqm+ categories, and the rest in the unorganized/others category. We multiply the final number of houses with the monthly waste collection fee amount of Rs.50, 100, 200, and 0 (for unorganized), respectively. We end up with an annual collection of Rs. 532 Crores from the residential/household category.

Alright, please move on to the other 2 categories you mentioned earlier.

Yes, I am assuming that there are approximately 5,00,000 street vendors in Delhi. The total collection amount will be Rs.18 crores on an annual basis. For commercial establishments, they can be further divided into malls, medical establishments, retail outlets, HORECA & educational establishments. I am estimating the number of establishments per 10 lac citizens of Delhi, and the collection size on establishments is estimated according to their pre-conceived sizes. We end up with a final figure of Rs.44.118 Crore.

Alright. Go ahead. Their market share is about 70% for both. Continue wit your calculations.

Ok, then their estimated annual revenue from the waste collection in Delhi turns out to be Rs.415 Crore. Now that we have the figure, may I know what has the growth been in the past years?

The company’s revenues are growing at about 2-3% per annum.

The revenue growth rate and the market share are symbolic of the fact that the company has matured, and there doesn’t seem to be a lot of steam left in the waste collection business. As a backup, the underlying business of the company cannot unlock any value for our private equity firm.

Ok, what other parameters would you want to weigh the business’s ability to transition into an energy business?

I will be weighing the proposition on sources of returns, target specifics and industry attractiveness. As I mentioned, the business if converted to an energy-driven one, can give immense returns, however, the underlying business, even as a backup is a mature and unattractive one from our PE firm’s perspective. As far as the energy business is considered, the prospects are bright, the industry is rapidly growing, and there will be government support as well. However, there are major barriers, the foremost one being the knowledge and expertise barrier.

Ok, kindly elaborate on the barriers

Yes, based on the information about the company, and as per my understanding, it is evident that the company’s core operations are basic at their best, involving the collection and dumping of waste. They have neither the manpower nor the experience or even the expertise to convert waste into energy. It will be as good as establishing a new firm, and the only synergy that the two will have is that one will provide the other with waste.

Ok so, do you support the investment decision?

Based on this reasoning, I am of the view that owing to the target company’s incompetency, this will be an extremely risky and demanding investment for the PE firm. Hence, the PE firm should avoid investing.

Ok, thanks. We can close the case now.

Case Facts

- Our Private Equity firm is focused towards Green investing.

- The waste management company is a service oriented company, and doesn’t possess technical knowledge to be able to convert waste into energy.

Approach

Case Recommendation

- For the PE Firm: Find more attractive investment opportunities, which match its vision and investment criteria

- For the Waste Management Company: If a foray in technical business is tough, discover expanding geographically, in the same business line.

Brownie Points

- The interviewee takes into consideration the PE Firm’s characteristics, and focus while investing.

- The interviewee has given the conclusion in light of the existing capabilities of the company .

Guesstimates