Lights, Camera, Action

Case Statement :

Bravo Capital is looking to invest in a production house for creating a superhero movie. You have been hired to recommend which production house should the company invest in.

Interview Transcript

Bravo Capital is looking to invest in a production house for creating a superhero movie. You have been hired to recommend which production house should the company invest in.

Has Bravo Capitalist made prior investments in film productions? And in what other sectors has the company invested in?

No, Bravo Capital is a PE Firm. It has a diverse portfolio in various sectors, but it is the first time that the company is looking to invest in the entertainment industry and has no prior investments in sectors related to film production.

What are the company’s objectives regarding this investment avenue? Is the company in it for a single production or multiple future projects?

The company plans to invest in the possibility of multiple renditions of a newly introduced character, but it depends largely on the performance of the first instalment.

What is the projected investment budget? What are the company’s benchmark criteria to decide whether to continue with the project?

The potential investment budget ranges between $150M – $250M.

With the average return from superhero action movies ranging from 20-30%, it expects the return to at least remain in this range, if not more than that.

Can you provide a brief overview of the superhero film industry?

Sure. The superhero films industry is booming due to the innovation in cinematic graphics processes making them a spectacle among the young and ever-growing audience of the spectrum. The market size is valued at $28.5 billion and growing. The growth is driven by streaming, technology, and existing franchises. Asia Pacific is the fastest growing region due to population and income.

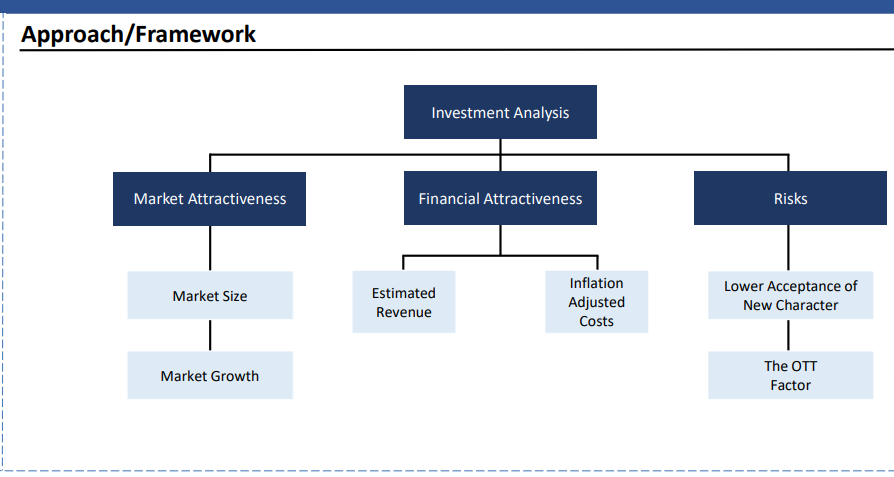

Alright. So, investing in this ever-growing sector would be beneficial to the client. The way I see it is that the best way to go forward would be to compare two of the biggest production houses, Marvel CU and DCEU, in this segment.

Yeah, sure. Go ahead with the two major players only.

Are the financials and the facts of the latest productions of these production houses readily available?

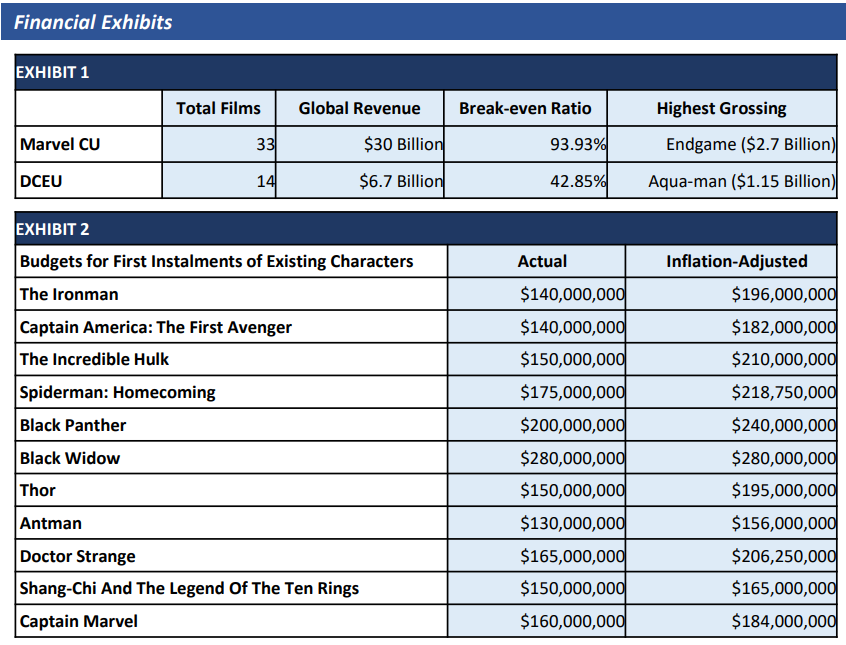

The financials and the related data are listed in Exhibit 1. You can refer to that.

Based on the data in Exhibit A, Marvel is the clear choice. Its global revenue is almost 5 times that of DCU. It has a phenomenal break-even ratio, indicating that all production costs are met easily and the rest is for the investors to take. DCEU pales in this comparison as well. The last three films that have been produced by Marvel have been a financial success, whereas DCEU is nearing the break-even point with all of its productions

. Alright, that inference seems more than fair. Move ahead with the case.

We would like to proceed with estimating the cost and revenues for producing a new character movie. We would be guesstimating the fanbase for the new character, figures of estimated revenues and costs, and making assumptions therein.

Sure. Go ahead with the guesstimate.

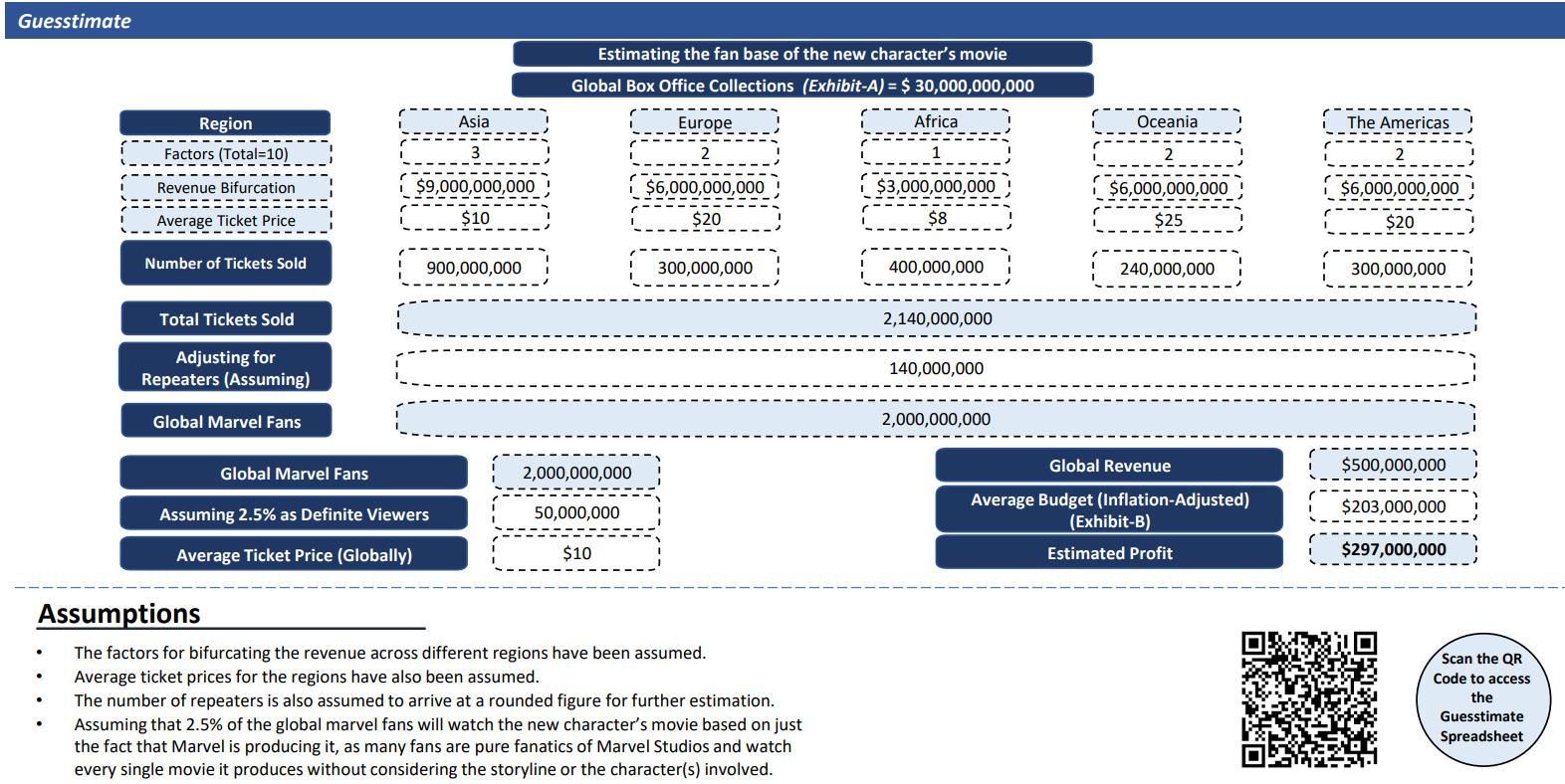

We’ll begin by bifurcating the Total Box Office Collections as per the different regions. This figure can be taken from Exhibit A itself, which is $30 Billion.

We’ll assume factors for the different regions to be taken into consideration as follows:

Asia: 3/10

Africa: 1/10

Oceania: 2/10

Europe: 2/10

The Americas: 2/10

Alright, how will you further estimate the new character’s fanbase, revenue, and cost?

We’ll now assume the average ticket prices for these regions, and then divide the region-wise revenue by their respective ticket price to arrive at the number of tickets sold.

This figure will help estimate the number of fans in each region.

Average ticket prices assumed:

Asia: $10

Africa: $7.5

Oceania: $25

Europe: $20

The Americas: $20

Alright, this seems fair and logical in arriving at the number of fans.

After dividing the revenue by the ticket prices, we will accumulate the number of fans from a regional to a global basis. Then after adjusting for repeaters, we will arrive at the true number of estimated fans.

Total number of tickets sold is 2.1 billion

Total number of fans is 2 billion after adjusting for repeaters, assumed to be 0.1 billion.

How would you use these figures to arrive at the number of fans for a new character movie?

We assume that 2.5% of these fans would be interested in watching a new character’s first instalment based on the fact that Marvel is producing it.

So, the lower ceiling of the number of fans for the new character is 50 million

Now, we would be using this number to estimate the revenue by multiplying the average ticket price by the number of fans.

For estimating the cost of the project, we would require the inflation-adjusted budgets for the initial instalments of the existing characters.

Alright. This data can be referred to in Exhibit B.

Taking the average ticket price as $10.

Revenue for the project would come out to be $500 million.

Production cost for the project has been computed based on the inflation-adjusted budgets provided in Exhibit B.

Production Costs: $203 Million

Okay, now that the estimated revenues and costs have been computed. What would you recommend to Bravo Capitalist?

As the investment in such a project is estimated to yield a profit of $297 Million. We would recommend Bravo Capitalist go ahead with the investment, and possibly enter into a long-term sustainable partnership with Marvel, and combine it within Marvel’s Cinematic Universe.

Alright. Since the profits have been computed, now throw some light on the risks associated with this line of films.

Alright, following are the major risks involved in funding a new movie project:

OTT Factor: Most of the target audience now watches their favorite movies in the comfort of their own space through the various OTT applications available. Nonetheless, people still prefer to watch a new movie, specially of the superhero segment, at least once in a theatre to soak in all the thrill of it all. Although, if proper attention is not given to this problem, it can be a major factor for a production’s loss.

Lower Acceptance: Given the hardcore fan base of Marvel, it sometimes becomes unnecessarily hard to introduce a new character, without facing significant backlash. The new character needs to put out in front of the audience in such a way that it seems relatable and feels like it belongs there with the rest of them. Eternals was one such project that was not marketed well and could not fit in with the rest of the existing characters

These are the major risks involved in this project.

Alright. Thanks, now we can conclude the case.

Case Facts

- Bravo Capitalist, a PE firm, is looking for investment avenues in different production houses for producing a superhero movie.

- Objectives: To evaluate the opportunity of finding a high NPV superhero movie project.

- Market Specifics:

Global Superhero Movie Market Size in 2023: $ 28.5 Billion

Expected Market Size by 2030: $ 43.7 Billion

Expected CAGR by 2030: 5.2%

Approach

Case Recommendation

- To opt for Marvel’s Production house for producing the movie.

- Forging a sustainable partnership with Marvel for multiple future projects.

- Introduce a new character and combine it with the already comprehensive cinematic universe rather than building on an existing character.

Brownie Points

- The cost of making the new movie has been computed by averaging the inflation-adjusted budgets of the existing characters’ first installments.

- Because many of the fans watch the same movie more than once, they have been adjusted.

Guesstimates

Financial Exhibits