Chat GPT 2.0

Case Statement :

The Client, a US-based end-to-end smart devices manufacturer, is looking to enter South Asia to sell its special AI-enabled software. Now ascertain the

attractiveness of the Indian market for your client and if the market deems fit devise a market entry strategy for them with planned capex investment

for 3 years.

Interview Transcript

The global smartphone market size was valued at USD 457.18 billion in 2021. The market is projected to grow from USD 484.81 billion in 2022 to USD 792.51 billion by 2029, exhibiting a CAGR of 7.3% during the forecast period. So to en-cash this opportunity our client, a US-based end-to-end smart devices manufacturer, is looking to enter South Asia to sell its special AI-enabled software. Now ascertain the attractiveness of the Indian market for your client and if the market deems fit devise a market entry strategy for them with planned capex investment for 3 years.

What is the main objective behind this market entry?

The company is looking to raise the next round of investment and for this purpose, they are looking to increase their revenue to get a higher valuation multiple.

Are they selling this AI-enabled software in any other country as of now? And also are they similar to ChatGPT and Bard in any way?

Yes, they are selling these bots in the US and Europe. The product has been a success there and has captured a market share of 35% and 39% respectively in the segment. Ignore the similarities between our product and other AI-enabled software for this case.

Does our client have any particular country in mind where they are looking to enter? What is the product mix of the Client?

They are looking to enter India, China, or Vietnam. Since it is an end-to-end smart devices manufacturer. It has a diverse product mix from smartphones to televisions smart, LED’S and even smartwatches.

The software used in these devices is also in-house production or do we have third-party tie-ups for it?

It is produced in-house.

Do we sell this software B2B to other companies for their products? Also, Since our client is a manufacturer. So will they import these products from different countries or are they willing to set up a plant here?

Yes we do sell B2B. The client hasn’t given a thought as to whether they will be importing or manufacturing in the country itself. You may begin with your approach now.

Now I would like to do an in-depth analysis of all three countries by providing a rough structure. I’ll try to give a brief summary about the respective by listing their pros and cons:

- CHINA

- Pros: Cheap labor cost and advanced technology.

- Cons: Disruptive Intellectual Property has a chance of a leak. China’s legal system usually punishes counterfeiting and IP theft.

- TAIWAN

- Pros: Biggest semiconductors producing country so the cost of making these bots would decrease exponentially due to the quick availability and proximity of the above and its creator.

- Cons: Geopolitical tensions, in case of invasion by China the capex investment might go in vain or might get stuck.

- INDIA

- Pros: Under the “Make in India” scheme the government is providing tax concessions and production-linked incentives which will push down the overall cost drastically.

- Cons: Infrastructure is not that sophisticated and developed in comparison to the other two countries. Problems like water logging may result in logistics issue if the production unit is set up in India.

Okay, so which country would you recommend the company to enter and what is the thing we can do to make a USP for our products?

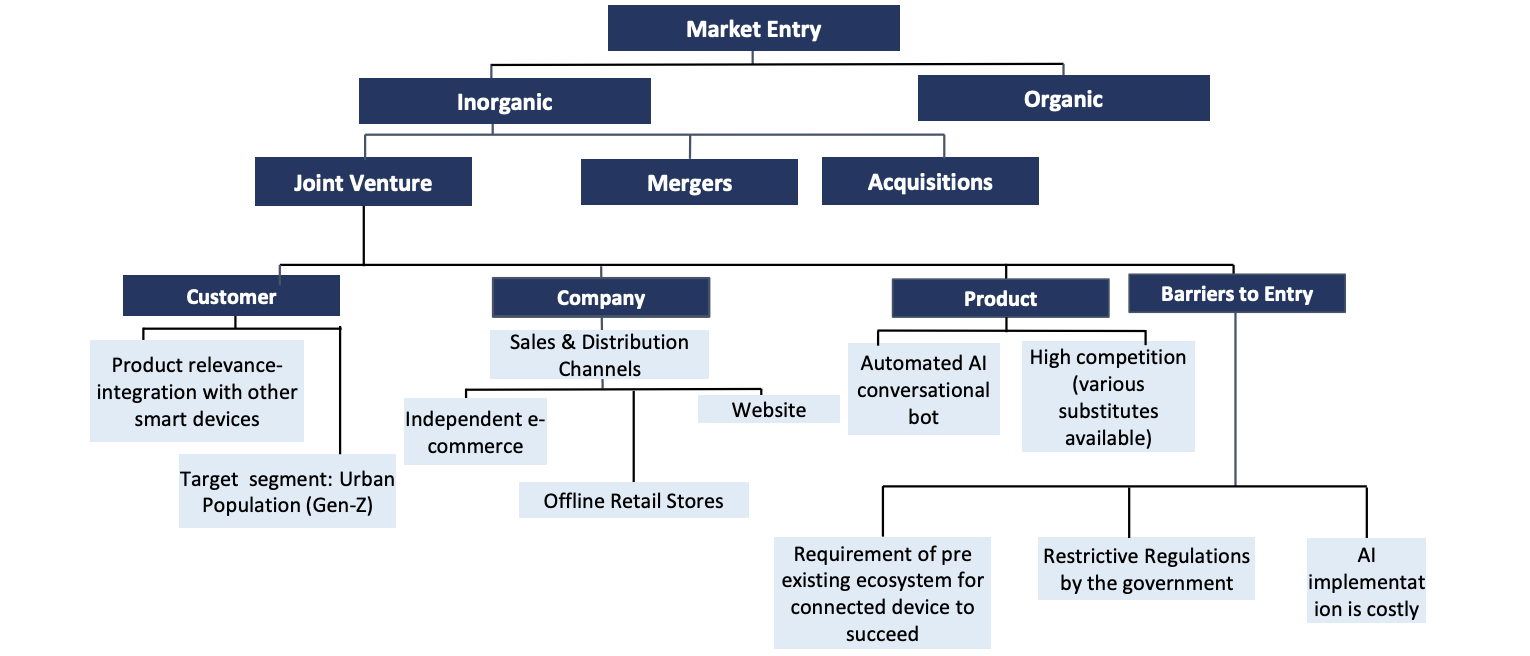

India as it is a low-risk and high-reward proposition. We can highlight the technical capabilities and relevance of our special AI software to showcase the product differentiation like- capable of media playback, Helps in making to-do lists, setting alarms for weather, traffic, sports, and other real updates. Product Relevance- integration with other smart devices i.e., smart televisions, housing and related appliances.

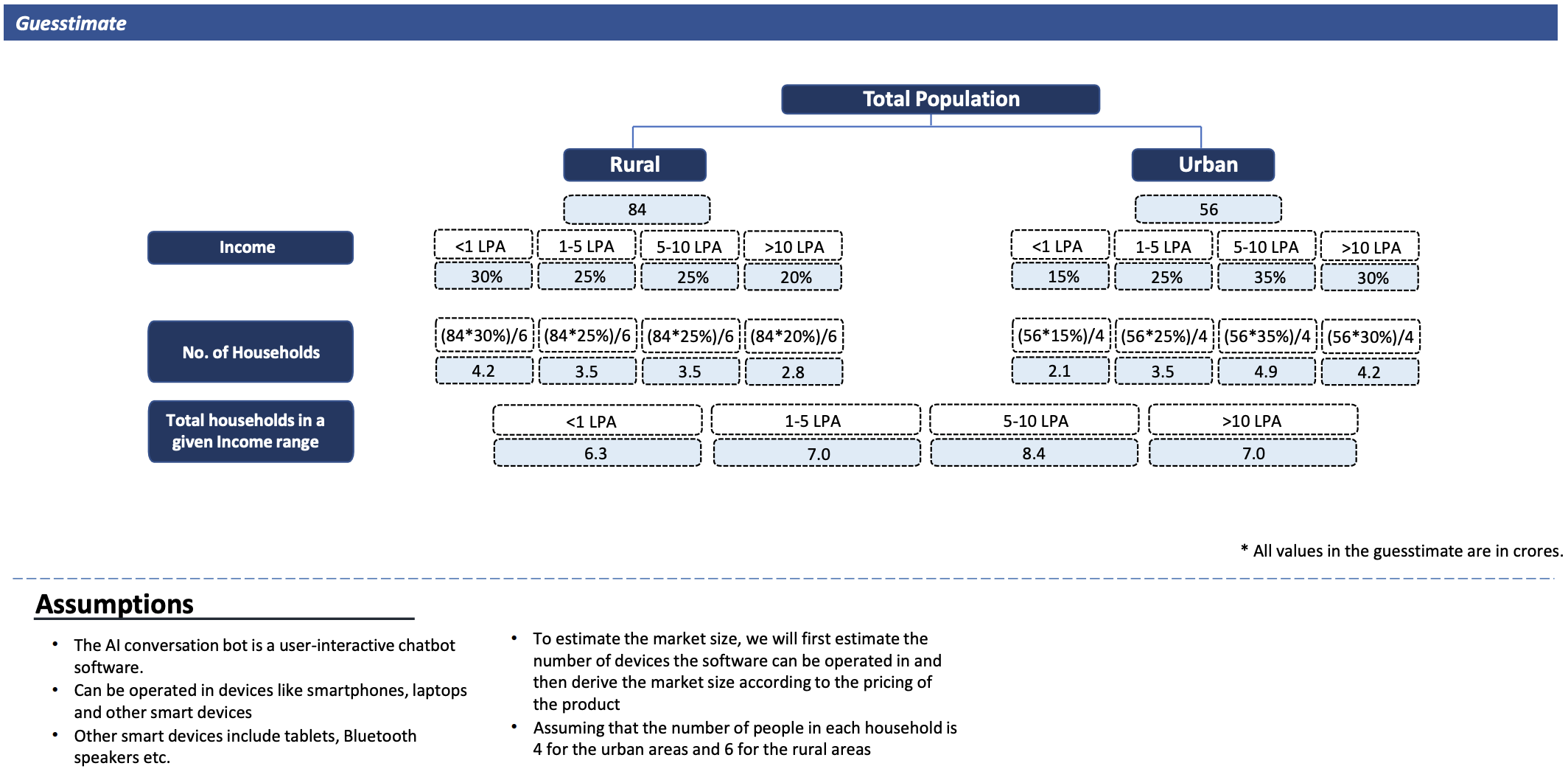

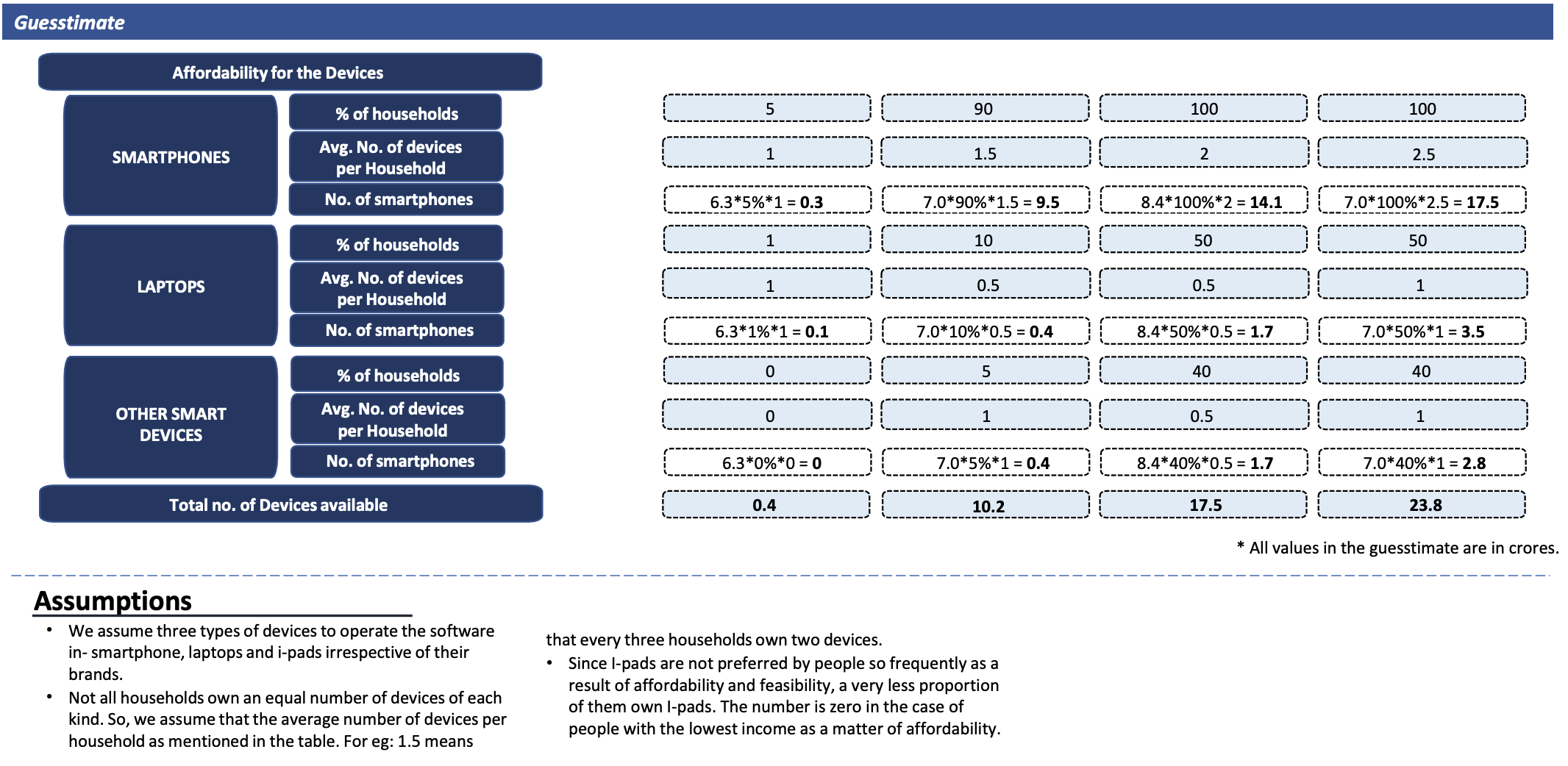

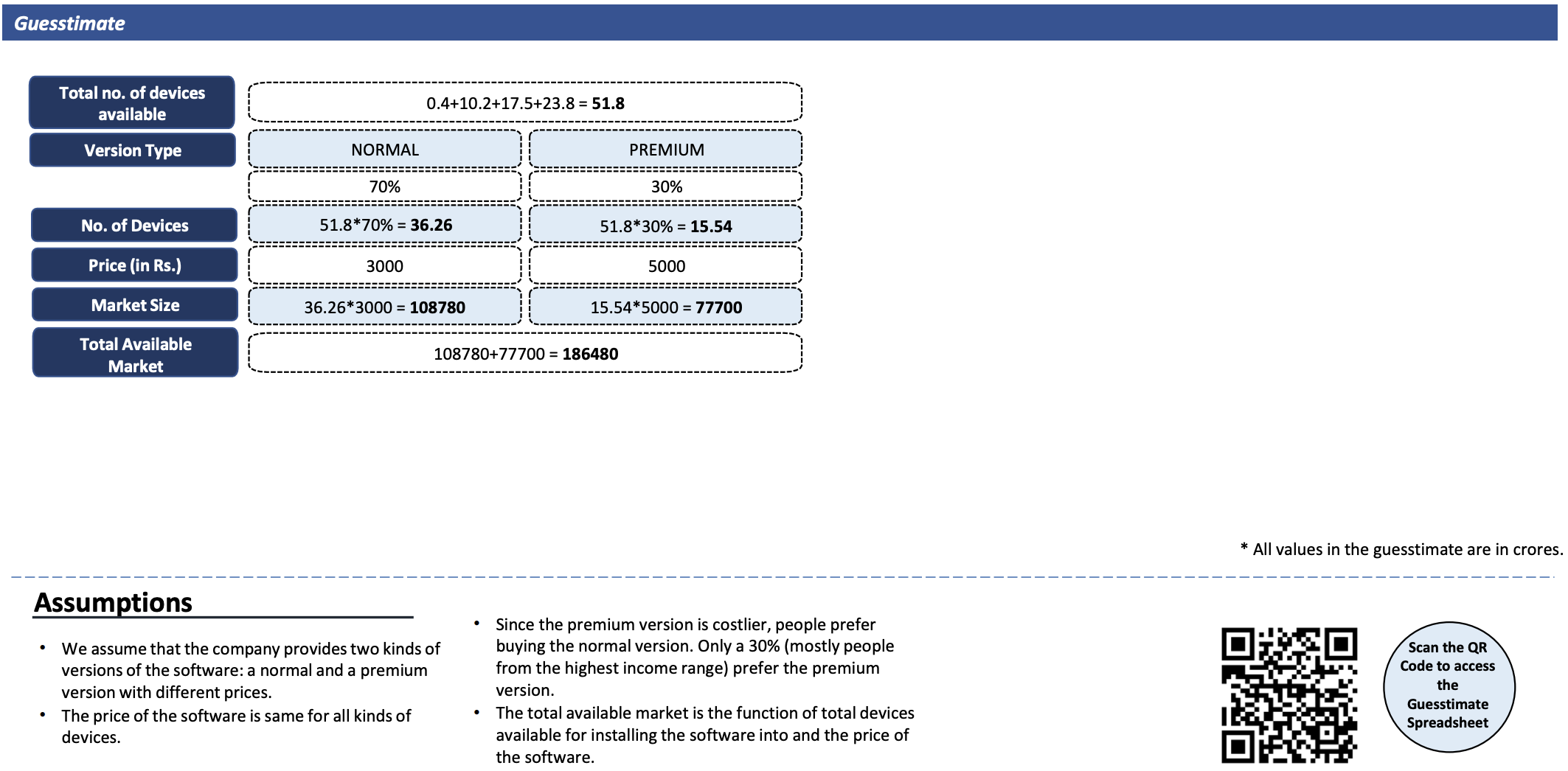

What will be our target customer? Calculate the total addressable market (TAM) for our product, prepare a guesstimate on it and what factors will drive our pricing strategy?

Urban population (specially generation-z) in the 8 metropolitan tier 1 cities and high-income groups in tier 2 and 3 cities. We can use price skimming in which we can charge a high initial price that customers will pay and then lower it over time. As the demand of the customers is satisfied and competition enters the market, we will lower the price to attract another, more price-sensitive segment of the population. Also, do you have a timeline in mind for the market entry?

Don’t focus on this. Please explore the options for market entry.

There are two ways of entering a market. Organically and inorganically, so, what would the company look to enter the Indian market?

Since we want the results to quickly reflect on our accounting statements so doing everything from scratch won’t be feasible, so what would you recommend in an inorganic way? Do an analysis for each case a- joint venture, merger, or acquisition.

The acquisition would require a big capex investment from our side and also there is no mid or small-size firm working or making strides in the particular domain for AI in India so an acquisition might require ground-up work. A joint venture can be a better way to expand in the Indian market because through that we will be able to get the association of that brand with us which will result in better customer acquisition and would reduce the customer acquisition cost as the established brand name would also act as the pulling factor for customers.

Okay go ahead with this option. What are the prospective business houses we can collaborate with?

Veliance might be a very good option for this due to its diversified business and its presence in both online and offline space through Vio Mart and Veliance retail offline (Veliance Digital). Through this, we will have a strong distribution network.

List some other benefits of this proposed joint venture too.

Through a joint venture we will also enter into a B2B type of business model where we will have our payments upfront which would reduce the company’s exposure to business risk and will also ensure better cash flows.

Okay but why would a company of such a size enter into a joint venture with us?

The company might enter into a joint venture with us, owing to the certain benefits/deliverables like:

- We will provide our special AI software to Veliance, to be run exclusively in their devices. It will be akin to what Apple has in their devices, in the form of Siri.

- We can also enter into a future dated agreement with Vio, if they decide to enter the US then we can provide their employees with training and could share our manufacturing facility.

Okay you can close the case now.

Case Facts

- The client is an end-to-end US based smart device manufacturer.

- The product has been a success in US and Europe and has captured a market share of 35% and 39% respectively in the segment.

- The client is an in-house producer and sells the software B2B to other companies as well.

- Objectives: To increase the revenues in order to get higher valuation multiples & to raise new investments into their portfolio.

- Market Specifics:

Global smartphone market size in 2021: USD 457.18 Bn

Expected market size by 2029: 792.51 Bn

Expected CAGR: 7.3%

Approach

Case Recommendation

- To launch in India: JV with Veliance, to exclusively provide the software for their products.

- A joint venture with Vio is: if they plan to enter US market, to provide training to their employees and share manufacturing facilities.

Brownie Points

- Asking questions pertaining to Chat GPT. Shows awareness about the present trends.

- Taking geopolitical factors into consideration before making investment decision.

- Addressing the need for introduction of Indian languages in the software.

Guesstimates